Question: Problem 4. (30pts) A drill rig is required for an upcoming project. Consider the following 2 options: Option 1) A new drill rig costs $500,000.

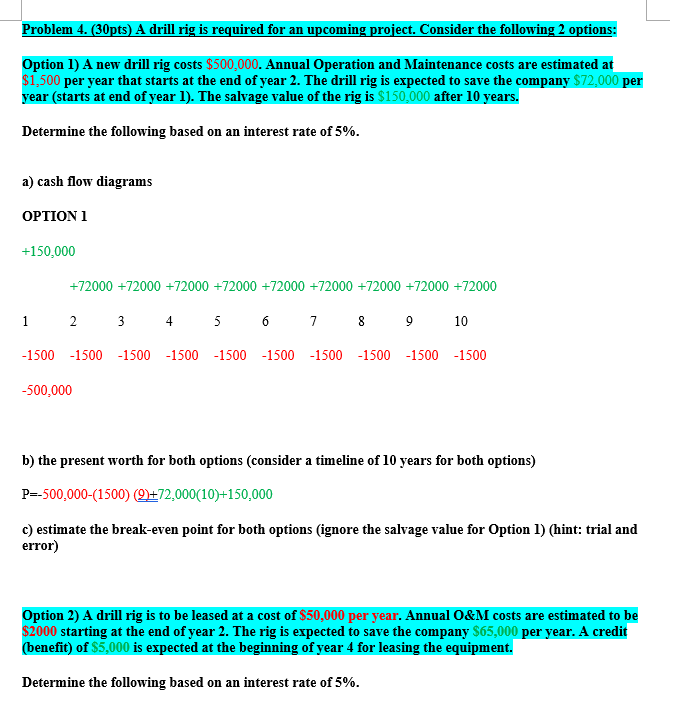

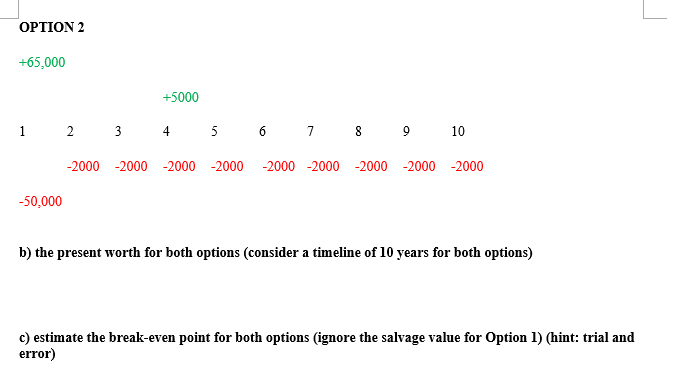

Problem 4. (30pts) A drill rig is required for an upcoming project. Consider the following 2 options: Option 1) A new drill rig costs $500,000. Annual Operation and Maintenance costs are estimated at $1,500 per year that starts at the end of year 2. The drill rig is expected to save the company $72,000 per year (starts at end of year 1). The salvage value of the rig is $150,000 after 10 years. Determine the following based on an interest rate of 5%. a) cash flow diagrams OPTION 1 +150,000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 1 2 3 4 5 6 7 8 9 10 -1500-1500 -1500 -1500 -1500-1500-1500-1500 -1500-1500 -500,000 b) the present worth for both options (consider a timeline of 10 years for both options) P=-500,000-(1500) +72,000(10)+150,000 c) estimate the break-even point for both options (ignore the salvage value for Option 1) (hint: trial and error) Option 2) A drill rig is to be leased at a cost of $50,000 per year. Annual O&M costs are estimated to be $2000 starting at the end of year 2. The rig is expected to save the company $65,000 per year. A credit (benefit) of $5,000 is expected at the beginning of year 4 for leasing the equipment. Determine the following based on an interest rate of 5%. OPTION 2 +65,000 +5000 1 2 3 4 5 6 7 8 9 10 -2000-2000-2000-2000 -2000 2000-2000 2000-2000 -50,000 b) the present worth for both options (consider a timeline of 10 years for both options) c) estimate the break-even point for both options (ignore the salvage value for Option 1) (hint: trial and error) Problem 4. (30pts) A drill rig is required for an upcoming project. Consider the following 2 options: Option 1) A new drill rig costs $500,000. Annual Operation and Maintenance costs are estimated at $1,500 per year that starts at the end of year 2. The drill rig is expected to save the company $72,000 per year (starts at end of year 1). The salvage value of the rig is $150,000 after 10 years. Determine the following based on an interest rate of 5%. a) cash flow diagrams OPTION 1 +150,000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 +72000 1 2 3 4 5 6 7 8 9 10 -1500-1500 -1500 -1500 -1500-1500-1500-1500 -1500-1500 -500,000 b) the present worth for both options (consider a timeline of 10 years for both options) P=-500,000-(1500) +72,000(10)+150,000 c) estimate the break-even point for both options (ignore the salvage value for Option 1) (hint: trial and error) Option 2) A drill rig is to be leased at a cost of $50,000 per year. Annual O&M costs are estimated to be $2000 starting at the end of year 2. The rig is expected to save the company $65,000 per year. A credit (benefit) of $5,000 is expected at the beginning of year 4 for leasing the equipment. Determine the following based on an interest rate of 5%. OPTION 2 +65,000 +5000 1 2 3 4 5 6 7 8 9 10 -2000-2000-2000-2000 -2000 2000-2000 2000-2000 -50,000 b) the present worth for both options (consider a timeline of 10 years for both options) c) estimate the break-even point for both options (ignore the salvage value for Option 1) (hint: trial and error)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts