Question: Problem #4 (3/10): Six mutually exclusive projects A, B, C, D, E, and F, are being considered by XYZ They have been ordered by first

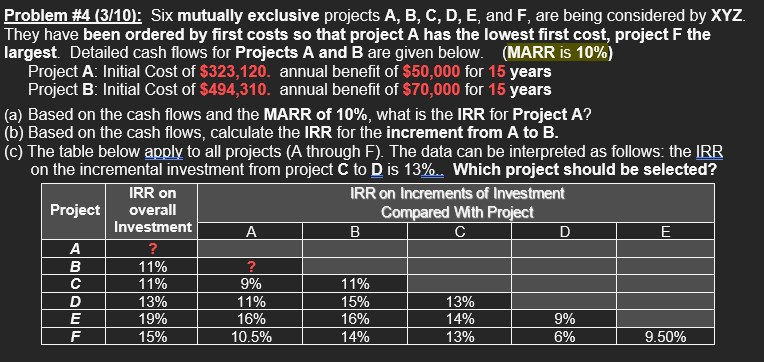

Problem \#4 (3/10): Six mutually exclusive projects A, B, C, D, E, and F, are being considered by XYZ They have been ordered by first costs so that project A has the lowest first cost, project F the largest. Detailed cash flows for Projects A and B are given below. (MARR is 10\%) Project A: Initial Cost of $323,120. annual benefit of $50,000 for 15 years Project B: Initial Cost of $494,310. annual benefit of $70,000 for 15 years (a) Based on the cash flows and the MARR of 10%, what is the IRR for Project A? (b) Based on the cash flows, calculate the IRR for the increment from A to B. (c) The table below apply to all projects (A through F ). The data can be interpreted as follows: the IRR on the incremental investment from project C to D is 13%. Which project should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts