Question: Problem 4 - 5 7 ( LO . 2 , 3 , 4 ) Herbert was employed for the first six months of 2 0

Problem LO

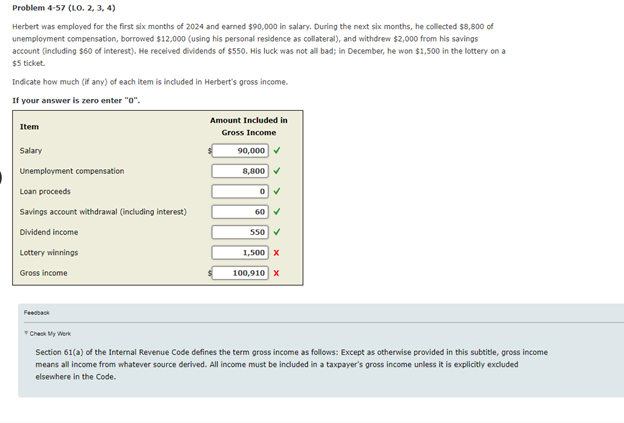

Herbert was employed for the first six months of and earned $ in salary. During the next slx months, he collected $ of

unemployment compensation, borrowed $using his personal residence as collateral and withdrew $ from his savings

account including $ of interest He received dividends of $ His luck was not all bad; in December, he won $ in the lottery on a

$ ticket.

Indicate how much if any of each item is included in Herbert's gross income.

If your answer is zero enter

Fetsack

"Check my Work

Section a of the Internal Revenue Code defines the term gross income as follows: Except as otherwise provided in this subtitle, gross income

means all income from whatever source derived. All income must be included in a taxpayer's gross income unless it is explicitly excluded

elsewhere in the Code.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock