Question: Problem 4: (8 Marks) You own a U.s exporting firm and will receive 10 million Swiss francs in 1 year. Assume that t rate parity

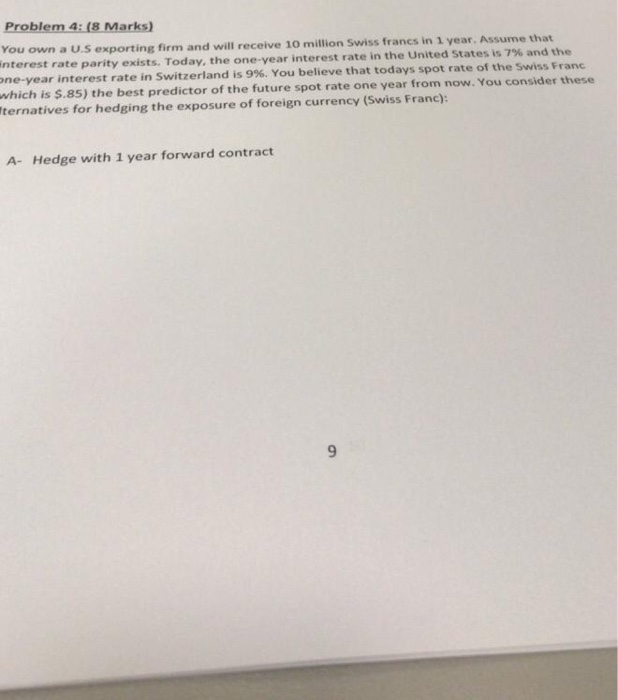

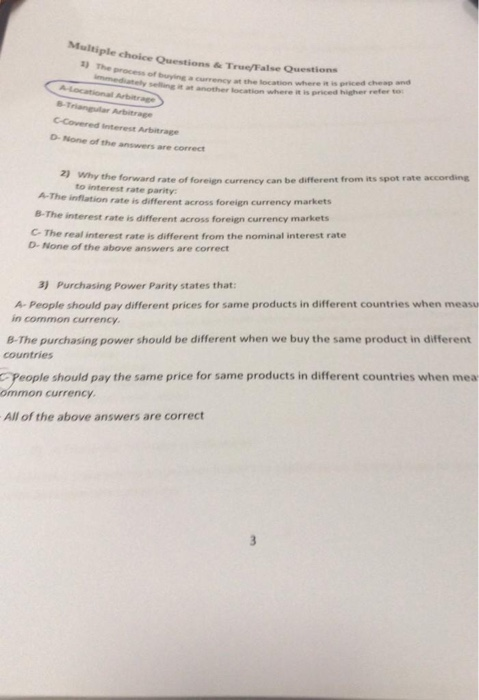

Problem 4: (8 Marks) You own a U.s exporting firm and will receive 10 million Swiss francs in 1 year. Assume that t rate parity exists. Today, the one-year interest rate in the United States is 7% and the ne-year interest rate in Switzerland is 9%. You believe that todays spot rate of the Swiss Franc which is $.85) the best predictor of the future spot rate one year from now. You consider these ternatives for hedging the exposure of foreign currency (Swiss Franc): A- Hedge with 1 year forward contract 9 choice Questions & True/False Questions 3) The of buying a currency at the location where it is priced cheap and refer to y selling it at another location where it is priced higher D- None of the answers are correct 2) Why the forward rate of foreien currency can be different from its spot rate according to interest rate parity: A-The inflation rate is different across foreign currency markets B- The interest rate is different across foreign currency markets C- The real interest rate is different from the nominal interest rate D- None of the above answers are correct Purchasing Power Parity states that: 3) 4- People should pay different prices for same products in different countries when measu in common currency B-The purchasing power should be different when we buy the same product in different countries People should pay the same price for same products in different countries when meas ommon currency. All of the above answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts