Question: PROBLEM 4 (8 points: 2 points for part a, 3 points for part b, and 3 points for part c) You own 400 shares of

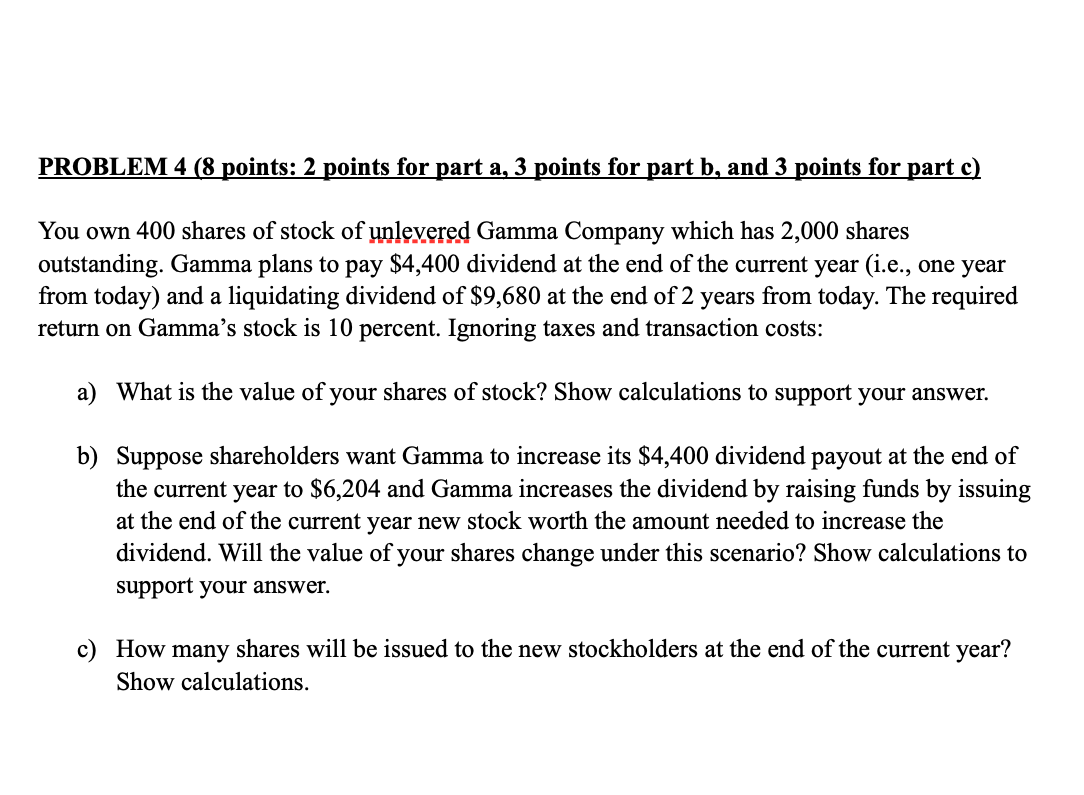

PROBLEM 4 (8 points: 2 points for part a, 3 points for part b, and 3 points for part c) You own 400 shares of stock of unlevered Gamma Company which has 2,000 shares outstanding. Gamma plans to pay $4,400 dividend at the end of the current year (i.e., one year from today) and a liquidating dividend of $9,680 at the end of 2 years from today. The required return on Gamma's stock is 10 percent. Ignoring taxes and transaction costs: a) What is the value of your shares of stock? Show calculations to support your answer. b) Suppose shareholders want Gamma to increase its $4,400 dividend payout at the end of the current year to $6,204 and Gamma increases the dividend by raising funds by issuing at the end of the current year new stock worth the amount needed to increase the dividend. Will the value of your shares change under this scenario? Show calculations to support your answer. c) How many shares will be issued to the new stockholders at the end of the current year? Show calculations. PROBLEM 4 (8 points: 2 points for part a, 3 points for part b, and 3 points for part c) You own 400 shares of stock of unlevered Gamma Company which has 2,000 shares outstanding. Gamma plans to pay $4,400 dividend at the end of the current year (i.e., one year from today) and a liquidating dividend of $9,680 at the end of 2 years from today. The required return on Gamma's stock is 10 percent. Ignoring taxes and transaction costs: a) What is the value of your shares of stock? Show calculations to support your answer. b) Suppose shareholders want Gamma to increase its $4,400 dividend payout at the end of the current year to $6,204 and Gamma increases the dividend by raising funds by issuing at the end of the current year new stock worth the amount needed to increase the dividend. Will the value of your shares change under this scenario? Show calculations to support your answer. c) How many shares will be issued to the new stockholders at the end of the current year? Show calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts