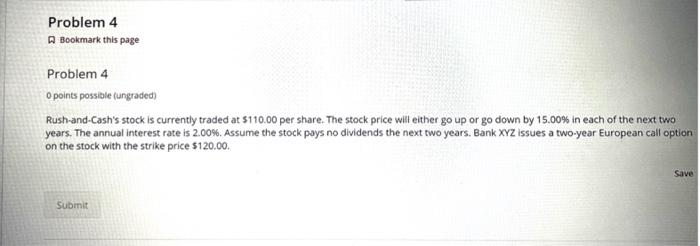

Question: Problem 4 A Bookmark this page Problem 4 0 points possible (ungraded) Rush-and-Cash's stock is currently traded at $110.00 per share. The stock price will

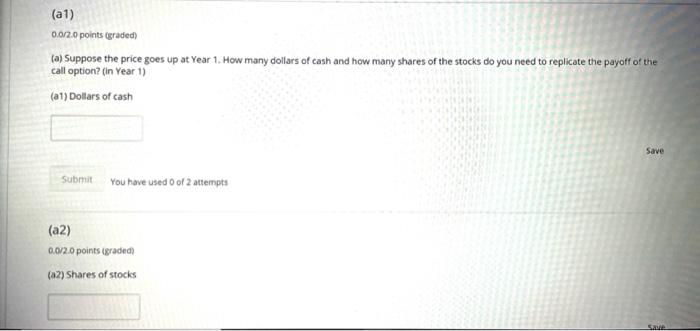

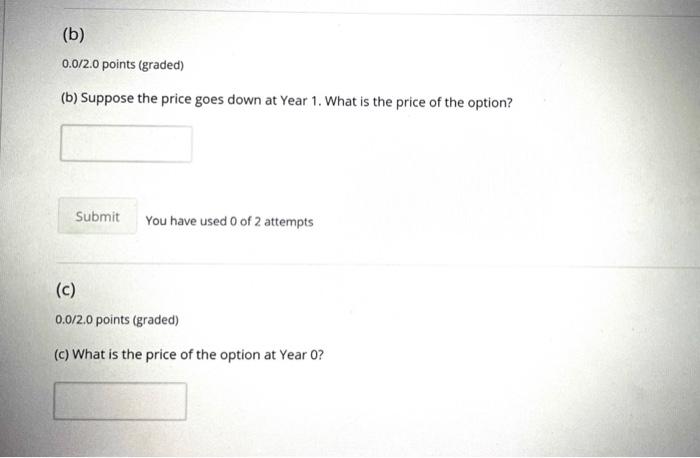

Problem 4 A Bookmark this page Problem 4 0 points possible (ungraded) Rush-and-Cash's stock is currently traded at $110.00 per share. The stock price will either go up or go down by 15.00% in each of the next two years. The annual interest rate is 2.00%. Assume the stock pays no dividends the next two years. Bank XYZ issues a two-year European call option on the stock with the strike price $120.00. Save Submit (at) 0.0/2.0 points (graded (a) Suppose the price goes up at Year 1. How many dollars of cash and how many shares of the stocks do you need to replicate the payoff of the call option? (in Year 1) (21) Dollars of cash Save Submit You have used 0 of 2 attempts (a2) 0.0/2.0 points (graded (2) Shares of stocks Se (b) 0.0/2.0 points (graded) (b) Suppose the price goes down at Year 1. What is the price of the option? Submit You have used 0 of 2 attempts (c) 0.0/2.0 points (graded) (c) What is the price of the option at Year 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts