Question: Problem #4: A corporation issues a 20 year bond with the final redemption value equal to the face value of S1000, and semiannual coupons of

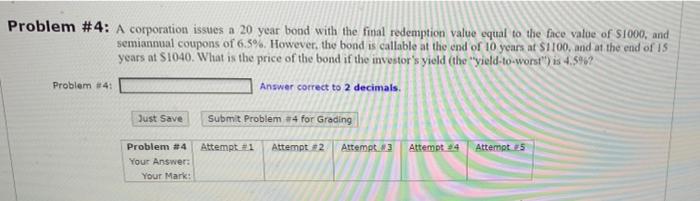

Problem #4: A corporation issues a 20 year bond with the final redemption value equal to the face value of S1000, and semiannual coupons of 6,5%. However, the bond is callable at the end of 10 years at $1100, and at the end of is years at 51040. What is the price of the bond if the investor's yield (the "yield-to-worst') is 4.5%? Problem #4 Answer correct to 2 decimals. Just Save Submit Problem 4 for Grading Problem #4 Attempt 1 Attempt #2 Attempt.: 3 Attempt 14 Attempt 75 Your Answer: Your Mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts