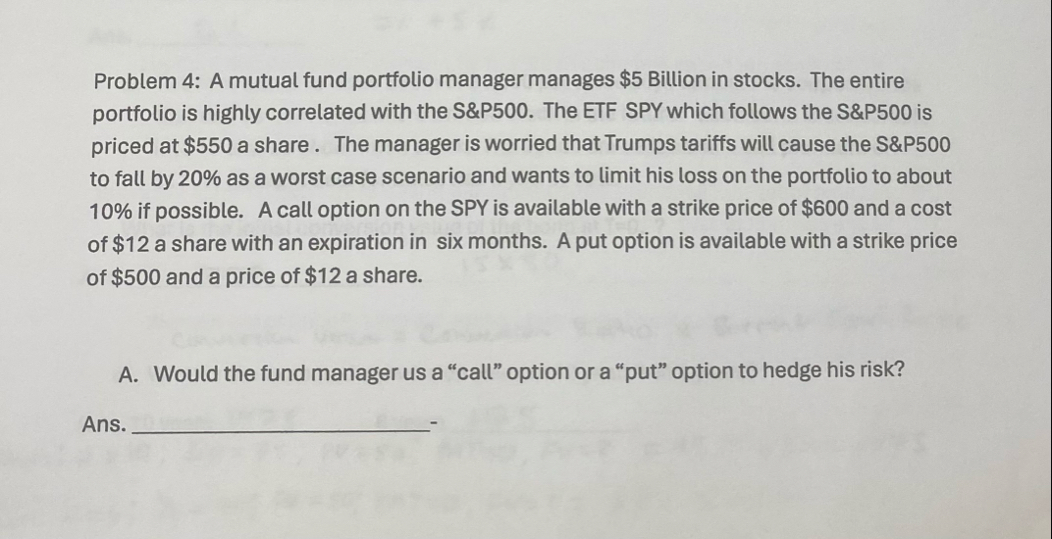

Question: Problem 4 : A mutual fund portfolio manager manages $ 5 Billion in stocks. The entire portfolio is highly correlated with the SProblem 4 :

Problem : A mutual fund portfolio manager manages $ Billion in stocks. The entire portfolio is highly correlated with the SProblem : A mutual fund portfolio manager manages $ Billion in stocks. The entire portfolio is highly correlated with the SProblem : A mutual fund portfolio manager manages $ Billion in stocks. The entire portfolio is highly correlated with the SProblem : A mutual fund portfolio manager manages $ Billion in stocks. The entire portfolio is highly correlated with the S

Problem : A mutual fund portfolio manager manages $ Billion in stocks. The entire portfolio is highly correlated with the S&P The ETF SPY which follows the S&P is priced at $ a share. The manager is worried that Trumps tariffs will cause the S&P to fall by as a worst case scenario and wants to limit his loss on the portfolio to about if possible. A call option on the SPY is available with a strike price of $ and a cost of $ a share with an expiration in six months. A put option is available with a strike price of $ and a price of $ a share.

A Would the fund manager us a "call" option or a "put" option to hedge his risk?

Ans.

b Each option contract is for shares. How many option contacts would the manager need to hedge his risk of keeping his losses to about Round your answer to the nearest integer. What is the total dollar cost of this hedge?

Ans. ans.

c Now assume in six months the S&P falls and his portfolio falls by Further, the SPY falls by What is the ending value of his portfolio?

Ans.

d What is the amount of money the manager made on his option hedge after subtracting the cost of the options?

Ans.

e What is the ending value of the portfolio after the drop in the market by when including the gain or loss on the option hedge.?

Ans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock