Question: Problem 4 Assume all the same facts as Problem 3 , except that Melissa maintains a Simplified Employee Pension ( SEP ) for herself and

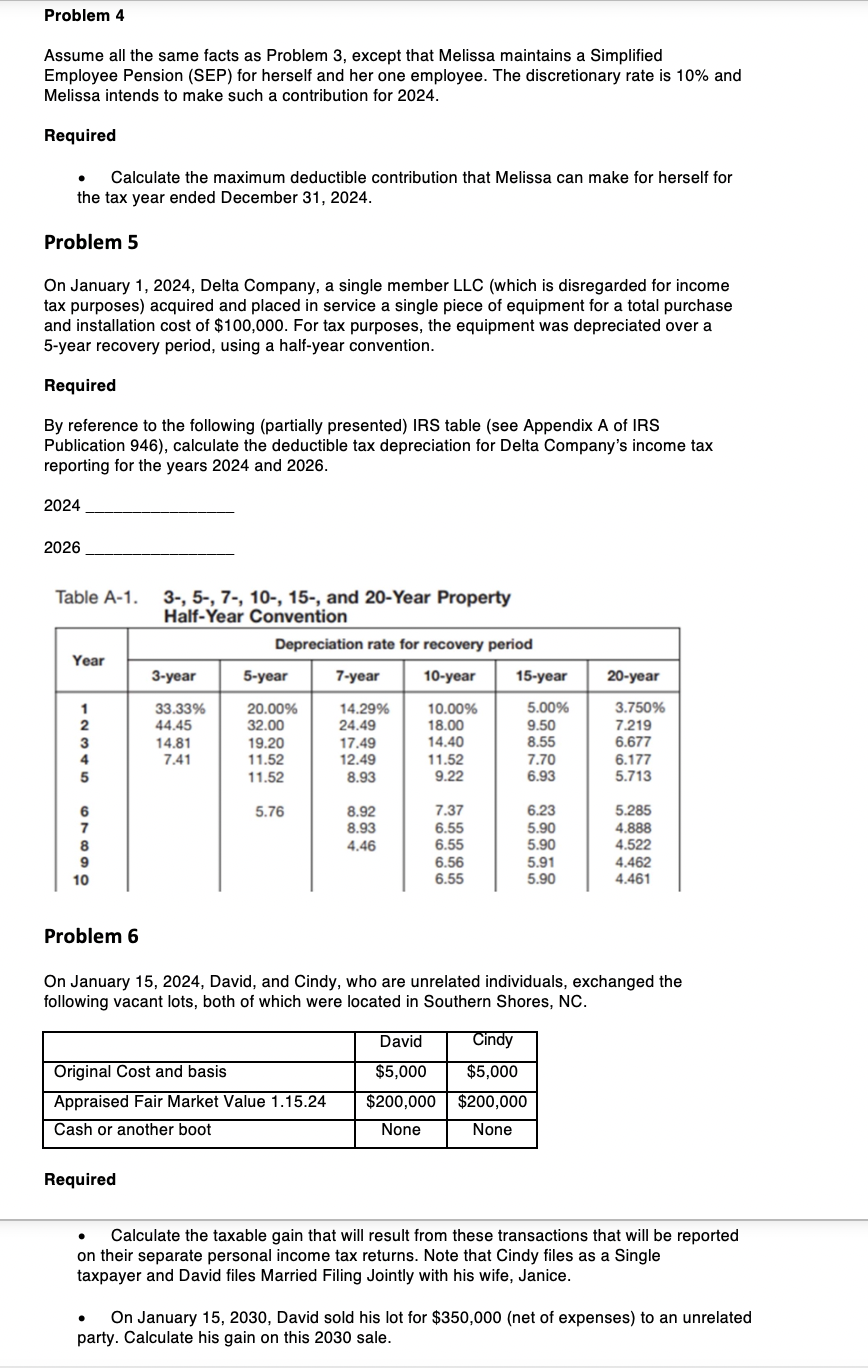

Problem Assume all the same facts as Problem except that Melissa maintains a Simplified Employee Pension SEP for herself and her one employee. The discretionary rate is and Melissa intends to make such a contribution for Required Calculate the maximum deductible contribution that Melissa can make for herself for the tax year ended December Problem On January Delta Company, a single member LLC which is disregarded for income tax purposes acquired and placed in service a single piece of equipment for a total purchase and installation cost of $ For tax purposes, the equipment was depreciated over a year recovery period, using a halfyear convention. Required By reference to the following partially presented IRS table see Appendix A of IRS Publication calculate the deductible tax depreciation for Delta Companys income tax reporting for the years and Problem On January David, and Cindy, who are unrelated individuals, exchanged the following vacant lots, both of which were located in Southern Shores, NC David Cindy Original Cost and basis $ $ Appraised Fair Market Value $ $ Cash or another boot None None Required Calculate the taxable gain that will result from these transactions that will be reported on their separate personal income tax returns. Note that Cindy files as a Single taxpayer and David files Married Filing Jointly with his wife, Janice. On January David sold his lot for $net of expenses to an unrelated party. Calculate his gain on this sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock