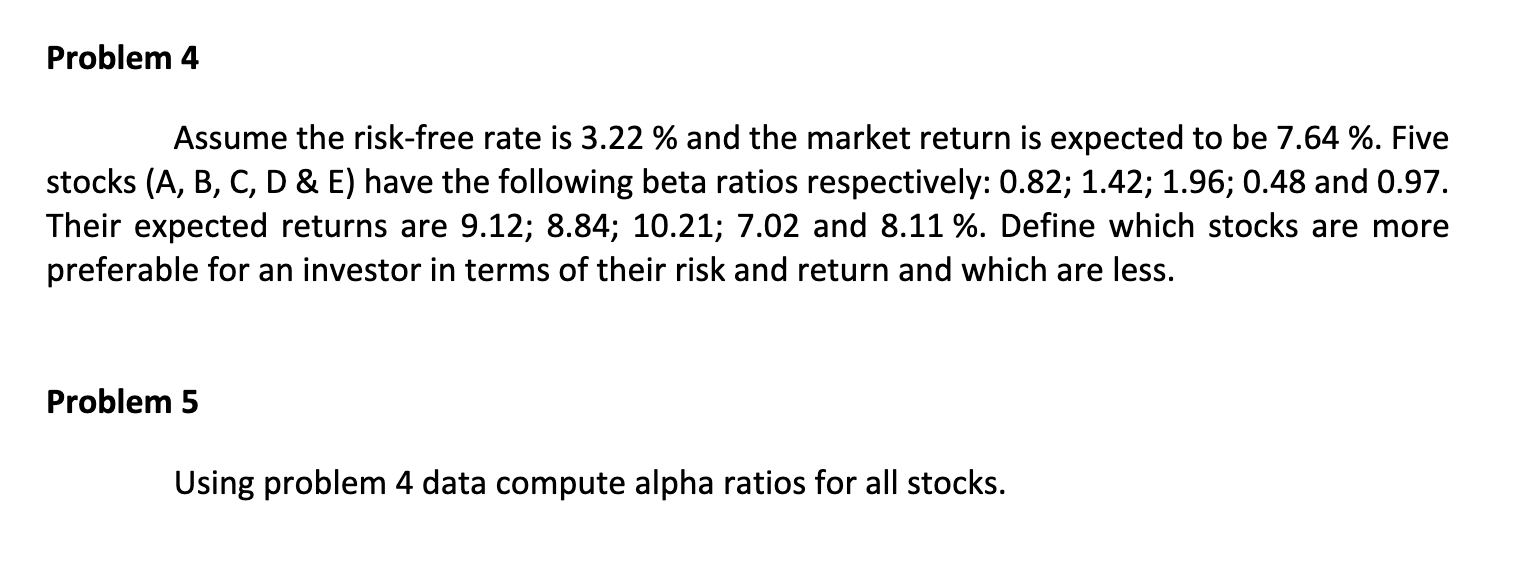

Question: Problem 4 Assume the risk - free rate is 3 . 2 2 % and the market return is expected to be 7 . 6

Problem

Assume the riskfree rate is and the market return is expected to be Five

stocks A B C D & E have the following beta ratios respectively: ;;; and

Their expected returns are ;;; and Define which stocks are more

preferable for an investor in terms of their risk and return and which are less.

Problem

Using problem data compute alpha ratios for all stocks.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock