Question: Problem 4: Assume the same facts as for Problem 3. A. For the lessor, is the lease a finance lease (sales-type) or an operating lease?

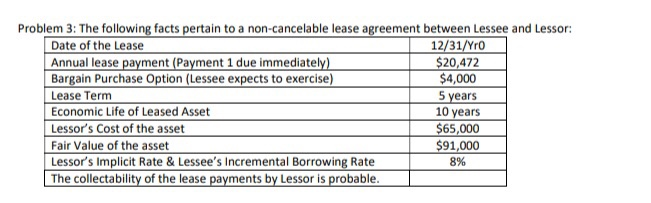

Problem 4: Assume the same facts as for Problem 3. A. For the lessor, is the lease a finance lease (sales-type) or an operating lease? Explain why or why not. B. Prepare the lessor's journal entries through 12/31/Yr1. Problem 3: The following facts pertain to a non-cancelable lease agreement between Lessee and Lessor: Date of the Lease 12/31/YO Annual lease payment (Payment 1 due immediately) $20,472 Bargain Purchase Option (Lessee expects to exercise) $4,000 Lease Term 5 years Economic Life of Leased Asset 10 years Lessor's Cost of the asset $65,000 Fair Value of the asset $91,000 Lessor's Implicit Rate & Lessee's Incremental Borrowing Rate 8% The collectability of the lease payments by Lessor is probable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts