Question: Problem 4: Black-Scholes Model NVIDIA stock (NVDA) currently trades at $273. The risk-free rate 's 4.5% and the stock's returns have an annual standard deviation

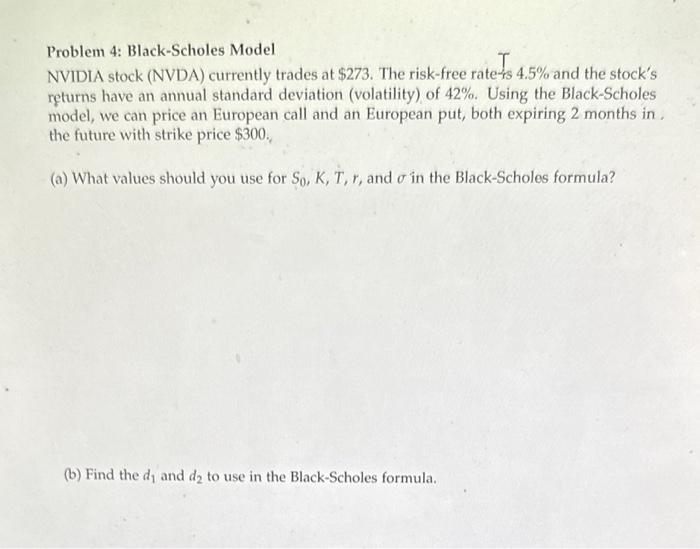

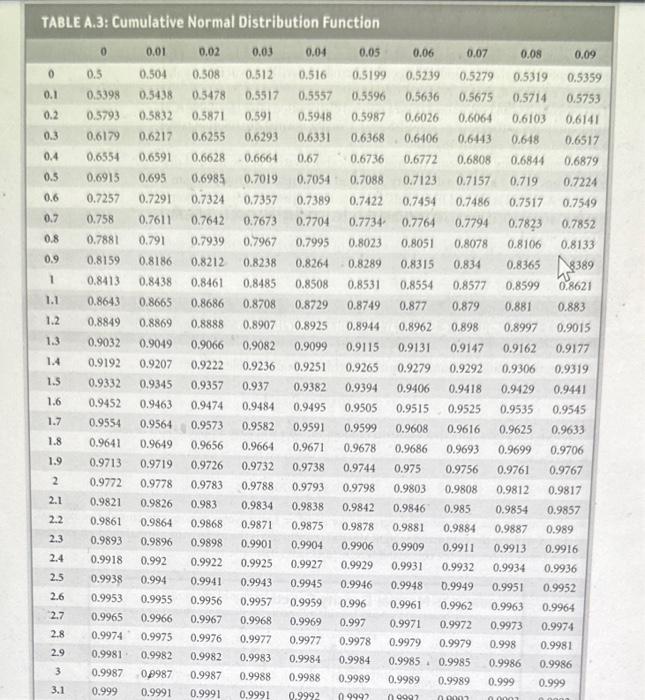

Problem 4: Black-Scholes Model NVIDIA stock (NVDA) currently trades at $273. The risk-free rate 's 4.5% and the stock's returns have an annual standard deviation (volatility) of 42%. Using the Black-Scholes model, we can price an European call and an European put, both expiring 2 months in. the future with strike price $300. (a) What values should you use for S0,K,T,r, and in the Black-Scholes formula? (b) Find the d1 and d2 to use in the Black-Scholes formula. (c) Using these d1 and d2, find the call price C0 and put price P0 ascording to the BlackScholes formula. TABLE A.3: Cumulative Normal Distribution Function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts