Question: PROBLEM 4. BOND VALUATION (25 POINTS) Assume you are observing two risk-free bonds with same two-year maturity and 1,000 par value. The first bond has

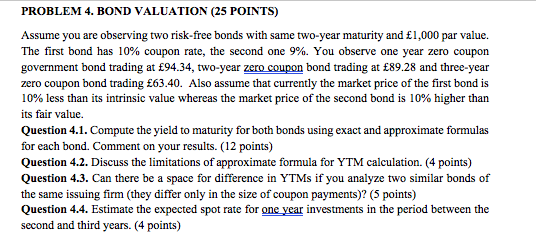

PROBLEM 4. BOND VALUATION (25 POINTS) Assume you are observing two risk-free bonds with same two-year maturity and 1,000 par value. The first bond has 10% coupon rate, the second one 9%. You observe one year zero coupon government bond trading at 94.34, two-year zero coupon bond trading at 89.28 and three-year zero coupon bond trading 63.40. Also assume that currently the market price of the first bond is 10% less than its intrinsic value whereas the market price of the second bond is 10% higher than its fair value. Question 4.1. Compute the yield to maturity for both bonds using exact and approximate formulas for each bond. Comment on your results. (12 points) Question 4.2. Discuss the limitations of approximate formula for YTM calculation. (4 points) Question 4.3. Can there be a space for difference in YTMs if you analyze two similar bonds of the same issuing firm (they differ only in the size of coupon payments)? (5 points) Question 4.4. Estimate the expected spot rate for one year investments in the period between the second and third years. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts