Question: PROBLEM# 4: Computing and estimating useful life (30 points) Please show your workings in Excel. All of work (even written answers) are on excel document

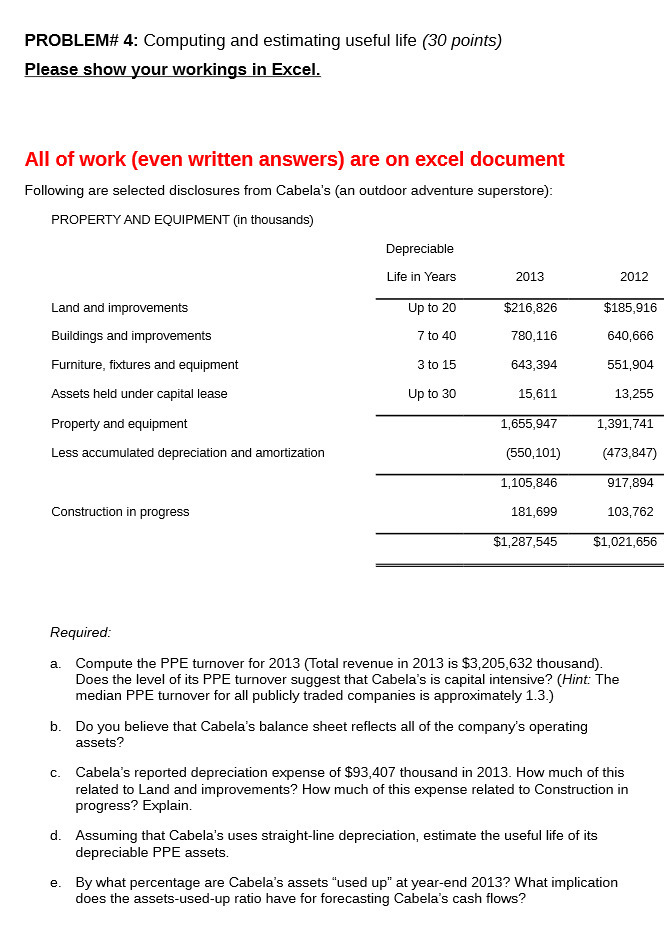

PROBLEM# 4: Computing and estimating useful life (30 points) Please show your workings in Excel. All of work (even written answers) are on excel document Following are selected disclosures from Cabela's (an outdoor adventure superstore): PROPERTY AND EQUIPMENT (in thousands) Depreciable Life in Years 2013 2012 Land and improvements Up to 20 $216,826 $185,916 Buildings and improvements 7 to 40 780,116 640,666 Furniture, fixtures and equipment 3 to 15 643,394 551,904 Assets held under capital lease Up to 30 15,611 13,255 Property and equipment 1,655,947 1,391,741 Less accumulated depreciation and amortization (550,101) (473,847) 1,105,846 917,894 Construction in progress 181,699 103,762 $1,287,545 $1,021,656 Required: a. Compute the PPE turnover for 2013 (Total revenue in 2013 is $3,205,632 thousand). Does the level of its PPE turnover suggest that Cabela's is capital intensive? (Hint: The median PPE turnover for all publicly traded companies is approximately 1.3.) b. Do you believe that Cabela's balance sheet reflects all of the company's operating assets? C. Cabela's reported depreciation expense of $93,407 thousand in 2013. How much of this related to Land and improvements? How much of this expense related to Construction in progress? Explain. d. Assuming that Cabela's uses straight-line depreciation, estimate the useful life of its depreciable PPE assets. e. By what percentage are Cabela's assets "used up" at year-end 2013? What implication does the assets-used-up ratio have for forecasting Cabela's cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts