Question: Problem 4. Consider two following two perpetuities. A perpetuity-immediate with effective interest rate of i. The payment is con- stant and equal to 100 in

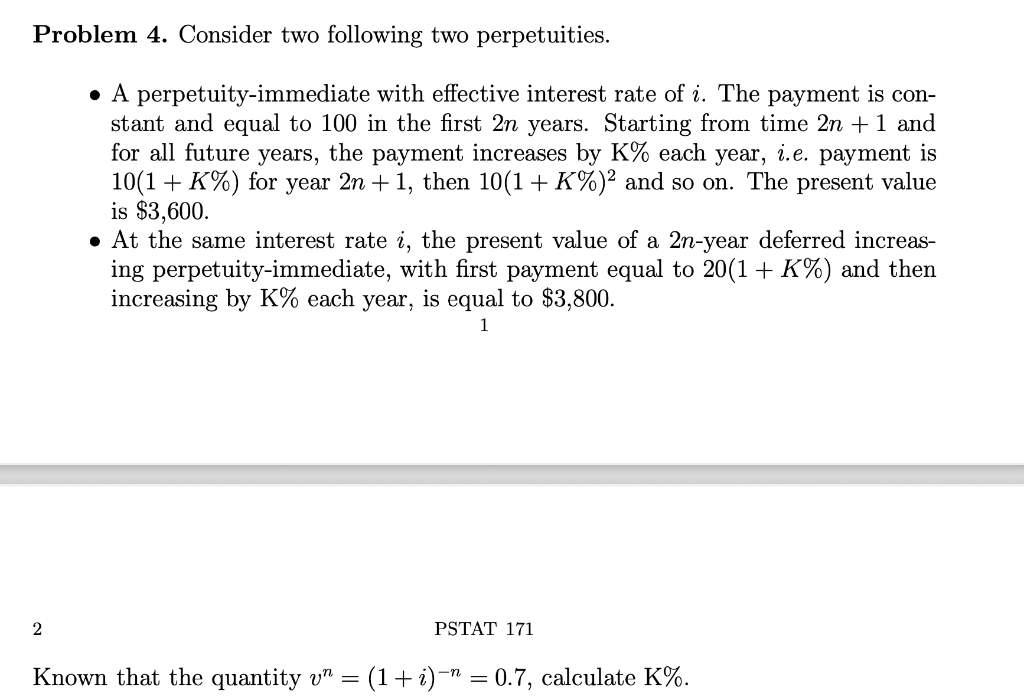

Problem 4. Consider two following two perpetuities. A perpetuity-immediate with effective interest rate of i. The payment is con- stant and equal to 100 in the first 2n years. Starting from time 2n + 1 and for all future years, the payment increases by K% each year, i.e. payment is 10(1 + K%) for year 2n + 1, then 10(1 + K%) and so on. The present value is $3,600. At the same interest rate i, the present value of a 2n-year deferred increas- ing perpetuity-immediate, with first payment equal to 20(1 + K%) and then increasing by K% each year, is equal to $3,800. 1 2 PSTAT 171 Known that the quantity v = (1 + i)" = 0.7, calculate K%. Problem 4. Consider two following two perpetuities. A perpetuity-immediate with effective interest rate of i. The payment is con- stant and equal to 100 in the first 2n years. Starting from time 2n + 1 and for all future years, the payment increases by K% each year, i.e. payment is 10(1 + K%) for year 2n + 1, then 10(1 + K%) and so on. The present value is $3,600. At the same interest rate i, the present value of a 2n-year deferred increas- ing perpetuity-immediate, with first payment equal to 20(1 + K%) and then increasing by K% each year, is equal to $3,800. 1 2 PSTAT 171 Known that the quantity v = (1 + i)" = 0.7, calculate K%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts