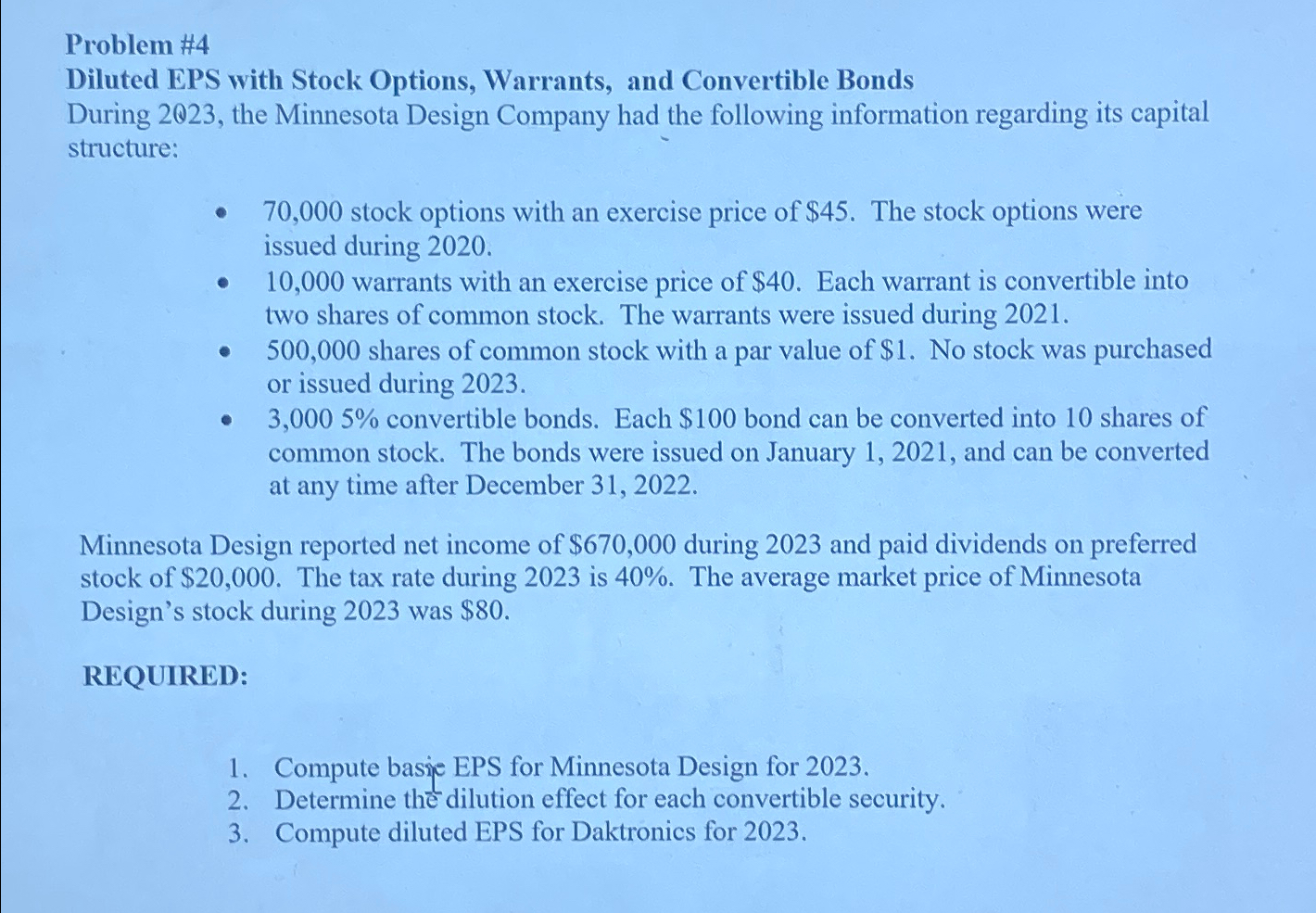

Question: Problem # 4 Diluted EPS with Stock Options, Warrants, and Convertible Bonds During 2 0 2 3 , the Minnesota Design Company had the following

Problem #

Diluted EPS with Stock Options, Warrants, and Convertible Bonds

During the Minnesota Design Company had the following information regarding its capital structure:

stock options with an exercise price of $ The stock options were issued during

warrants with an exercise price of $ Each warrant is convertible into two shares of common stock. The warrants were issued during

shares of common stock with a par value of $ No stock was purchased or issued during

convertible bonds. Each $ bond can be converted into shares of common stock. The bonds were issued on January and can be converted at any time after December

Minnesota Design reported net income of $ during and paid dividends on preferred stock of $ The tax rate during is The average market price of Minnesota Design's stock during was $

REQUIRED:

Compute basie EPS for Minnesota Design for

Determine the dilution effect for each convertible security.

Compute diluted EPS for Daktronics for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock