Question: Problem 4. Ding Inc., a US company, acquired a subsidiary in Switzerland on January 1, 2017 balance for January 1 and December 31 of 2017,

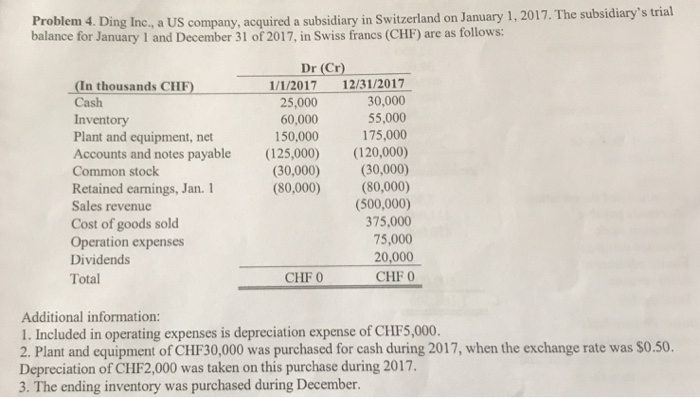

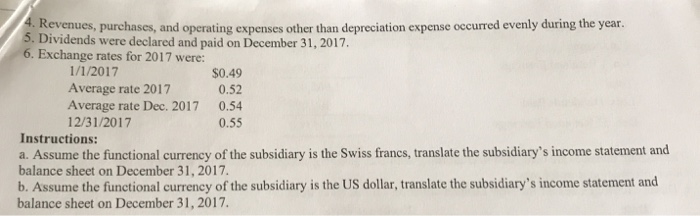

Problem 4. Ding Inc., a US company, acquired a subsidiary in Switzerland on January 1, 2017 balance for January 1 and December 31 of 2017, in Swiss francs (CHF) are as follows: . The subsidiary's trial Dr (Cr) (In thousands CHF Cash Inventory Plant and equipment, net Accounts and notes payable Common stock Retained earnings, Jan.1 Sales revenue Cost of goods sold Operation expenses Dividends Total 1/1/2017 12/31/2017 30,000 55,000 175,000 (120,000) (30,000) (80,000) (500,000) 375,000 75,000 20,000 CHF 0 25,000 60,000 150,000 (125,000) (30,000) (80,000) Additional information: 1. Included in operating expenses is depreciation expense of CHF5,000. 2. Plant and equipment of CHF30,000 was purchased for cash during 2017, when the exchange rate was $0.50. Depreciation of CHF2,000 was taken on this purchase during 2017. 3. The ending inventory was purchased during December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts