Question: Problem 4: e You bought both a call and a put, a European dollar call/Pound Sterling call option and a European dollar call/Pound Sterling put

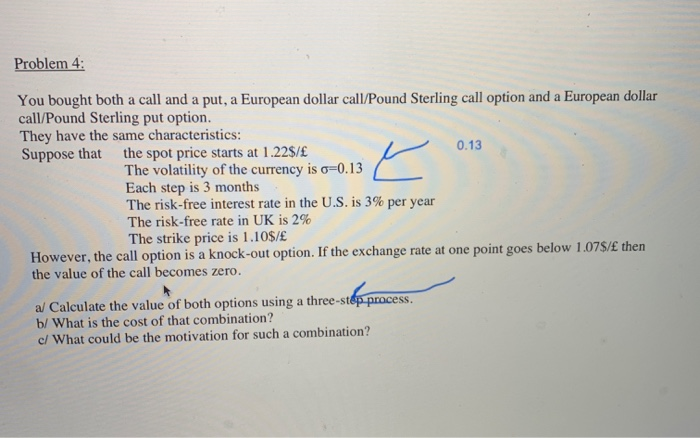

Problem 4: e You bought both a call and a put, a European dollar call/Pound Sterling call option and a European dollar call/Pound Sterling put option. They have the same characteristics: Suppose that the spot price starts at 1.22$/ 0.13 The volatility of the currency is o=0.13 Each step is 3 months The risk-free interest rate in the U.S. is 3% per year The risk-free rate in UK is 2% The strike price is 1.10$/ However, the call option is a knock-out option. If the exchange rate at one point goes below 1.07$/ then the value of the call becomes zero. al Calculate the value of both options using a three-step process. b/ What is the cost of that combination? c/What could be the motivation for such a combination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts