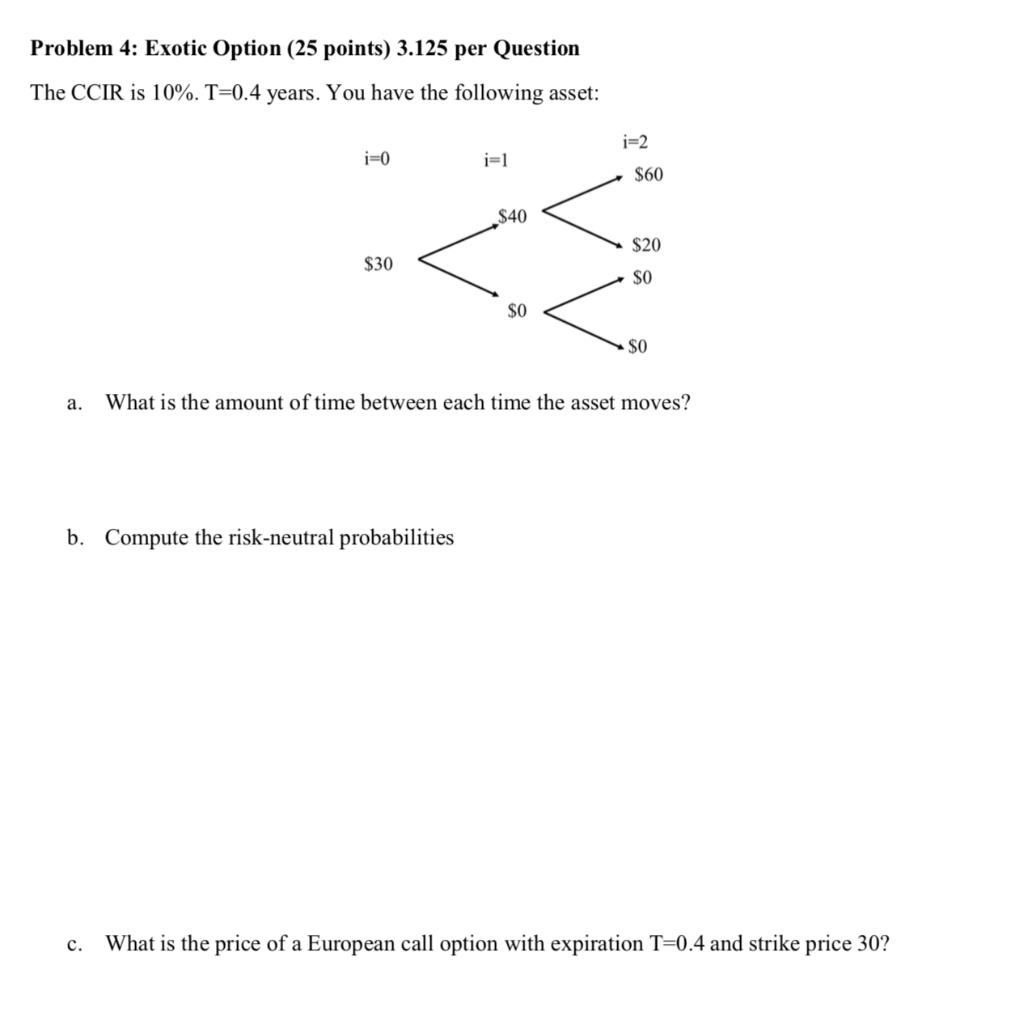

Question: Problem 4: Exotic Option (25 points) 3.125 per Question The CCIR is 10%. T=0.4 years. You have the following asset: i=2 i=0 i=1 $60 $40

Problem 4: Exotic Option (25 points) 3.125 per Question The CCIR is 10%. T=0.4 years. You have the following asset: i=2 i=0 i=1 $60 $40 $20 $30 $0 SO $0 a. What is the amount of time between each time the asset moves? b. Compute the risk-neutral probabilities c. What is the price of a European call option with expiration T=0.4 and strike price 30? d. Now assume that the call option in c) is American. Would the investor holding the option exercise it at t=0.2? e. What is the price of the American Call option in this case? Now, suppose that to the American option in d) we introduce a barrier. For instance, if the stock price ever crosses the threshold of $45, then the price of the underlying to compute the option payoff at T=0.4 is $45. If the price of the underlying never reaches $45, then the price of the underlying to compute the option payoff is simply the spot price at T=0.4 f. Is the American Option with Barrier ever exercised early at t=0.2? g. Compute the value of the option ABC at 0: h. What is the effect of the barrier on the exercise on an American Call Option? Problem 4: Exotic Option (25 points) 3.125 per Question The CCIR is 10%. T=0.4 years. You have the following asset: i=2 i=0 i=1 $60 $40 $20 $30 $0 SO $0 a. What is the amount of time between each time the asset moves? b. Compute the risk-neutral probabilities c. What is the price of a European call option with expiration T=0.4 and strike price 30? d. Now assume that the call option in c) is American. Would the investor holding the option exercise it at t=0.2? e. What is the price of the American Call option in this case? Now, suppose that to the American option in d) we introduce a barrier. For instance, if the stock price ever crosses the threshold of $45, then the price of the underlying to compute the option payoff at T=0.4 is $45. If the price of the underlying never reaches $45, then the price of the underlying to compute the option payoff is simply the spot price at T=0.4 f. Is the American Option with Barrier ever exercised early at t=0.2? g. Compute the value of the option ABC at 0: h. What is the effect of the barrier on the exercise on an American Call Option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts