Question: Problem 4: For each statement below, answer whether it is TRUE or FALSE, and explain thoroughly the logic behind your answers. 1. The duration of

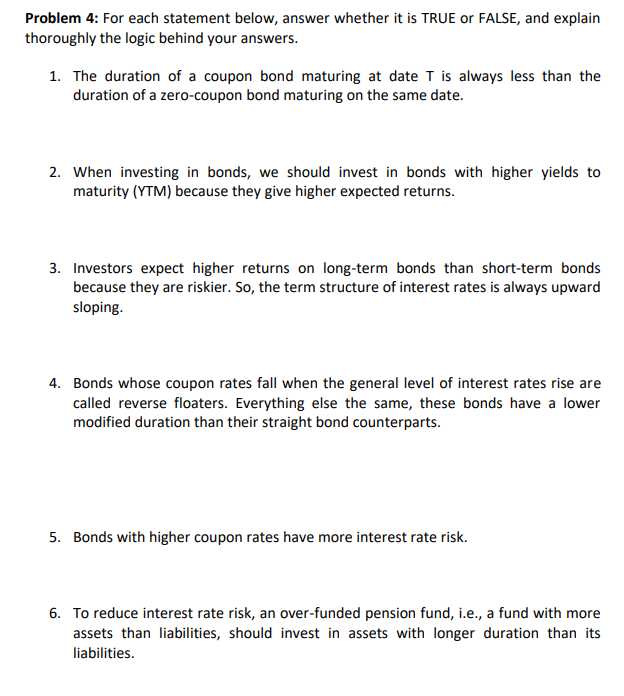

Problem 4: For each statement below, answer whether it is TRUE or FALSE, and explain thoroughly the logic behind your answers. 1. The duration of a coupon bond maturing at date T is always less than the duration of a zero-coupon bond maturing on the same date. 2. When investing in bonds, we should invest in bonds with higher yields to maturity (YTM) because they give higher expected returns. 3. Investors expect higher returns on long-term bonds than short-term bonds because they are riskier. So, the term structure of interest rates is always upward sloping. 4. Bonds whose coupon rates fall when the general level of interest rates rise are called reverse floaters. Everything else the same, these bonds have a lower modified duration than their straight bond counterparts. 5. Bonds with higher coupon rates have more interest rate risk. 6 To reduce interest rate risk, an over-funded pension fund, i.e., a fund with more assets than liabilities, should invest in assets with longer duration than its liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts