Question: Problem 4. (Forward curves, 8 ') The risk-free interest rate is 3% annualized and continuously compounded. Assume the market is frictionless. When you plot the

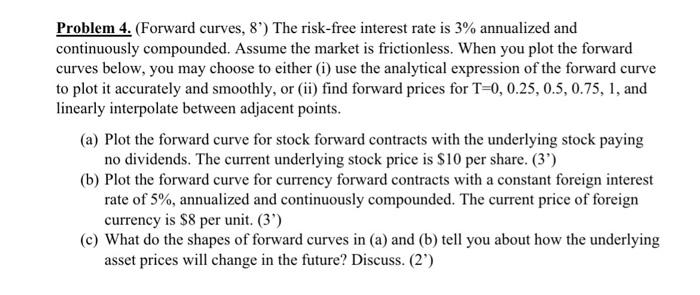

Problem 4. (Forward curves, 8 ') The risk-free interest rate is 3% annualized and continuously compounded. Assume the market is frictionless. When you plot the forward curves below, you may choose to either (i) use the analytical expression of the forward curve to plot it accurately and smoothly, or (ii) find forward prices for T=0,0.25,0.5,0.75,1, and linearly interpolate between adjacent points. (a) Plot the forward curve for stock forward contracts with the underlying stock paying no dividends. The current underlying stock price is $10 per share. (3') (b) Plot the forward curve for currency forward contracts with a constant foreign interest rate of 5%, annualized and continuously compounded. The current price of foreign currency is $8 per unit. (3') (c) What do the shapes of forward curves in (a) and (b) tell you about how the underlying asset prices will change in the future? Discuss. (2')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts