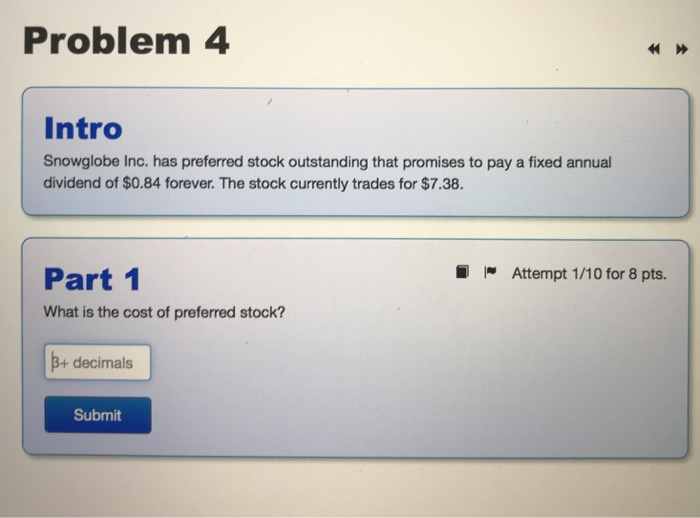

Question: Problem 4 H W Intro Snowglobe Inc. has preferred stock outstanding that promises to pay a fixed annual dividend of $0.84 forever. The stock currently

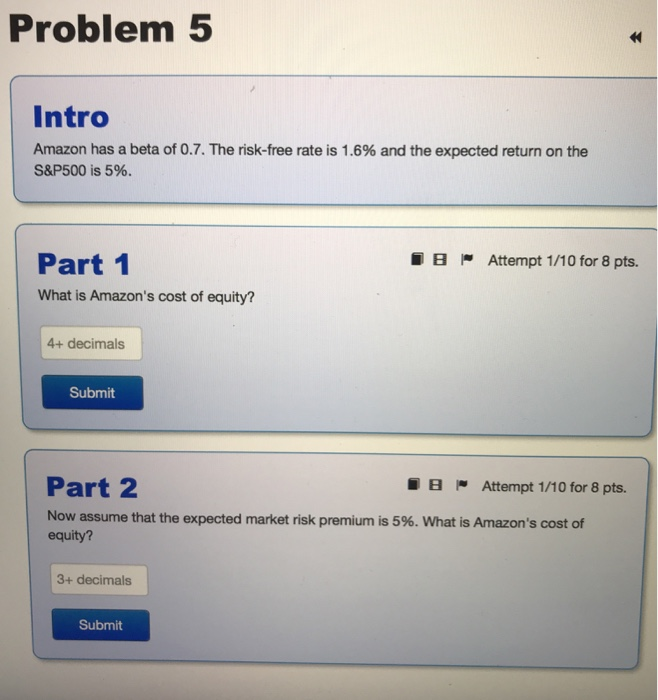

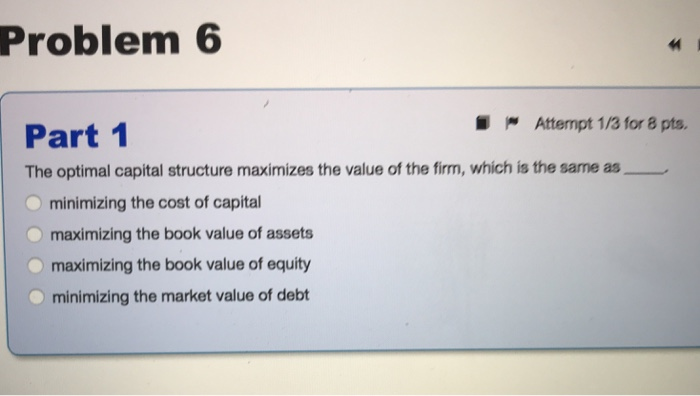

Problem 4 H W Intro Snowglobe Inc. has preferred stock outstanding that promises to pay a fixed annual dividend of $0.84 forever. The stock currently trades for $7.38. Part 1 What is the cost of preferred stock? Attempt 1/10 for 8 pts. B+ decimals Submit Problem 5 Intro Amazon has a beta of 0.7. The risk-free rate is 1.6% and the expected return on the S&P500 is 596. 8 Part 1 What is Amazon's cost of equity? - Attempt 1/10 for 8 pts. 4+ decimals Submit BAttempt 1/10 for 8 pts. Part 2 Now assume that the expected market risk premium is 5%. What is Amazon's cost of equity? 3+ decimals Submit Problem 6 4 Attempt 1/3 for 8 pts. Part1 The optimal capital structure maximizes the value of the firm, which is the same as minimizing the cost of capital maximizing the book value of assets maximizing the book value of equity minimizing the market value of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts