Question: Problem 4 Hello. Can I have the complete solution pls. and proper amortization table if necessary. I already uploaded this but some of the answers

Problem 4

Hello. Can I have the complete solution pls. and proper amortization table if necessary. I already uploaded this but some of the answers I got are wrong. I really need the correct answer. Thank you for your help

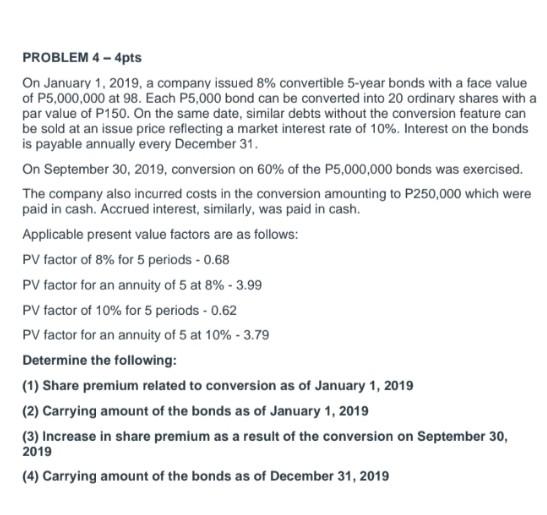

PROBLEM 4 - 4pts On January 1, 2019, a company issued 8% convertible 5-year bonds with a face value of P5,000,000 at 98. Each P5,000 bond can be converted into 20 ordinary shares with a par value of P150. On the same date, similar debts without the conversion feature can be sold at an issue price reflecting a market interest rate of 10% Interest on the bonds is payable annually every December 31. On September 30, 2019, conversion on 60% of the P5,000,000 bonds was exercised. The company also incurred costs in the conversion amounting to P250,000 which were paid in cash. Accrued interest, similarly, was paid in cash. Applicable present value factors are as follows: PV factor of 8% for 5 periods - 0.68 PV factor for an annuity of 5 at 8% - 3.99 PV factor of 10% for 5 periods - 0.62 PV factor for an annuity of 5 at 10% - 3.79 Determine the following: (1) Share premium related to conversion as of January 1, 2019 (2) Carrying amount of the bonds as of January 1, 2019 (3) Increase in share premium as a result of the conversion on September 30, 2019 (4) Carrying amount of the bonds as of December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts