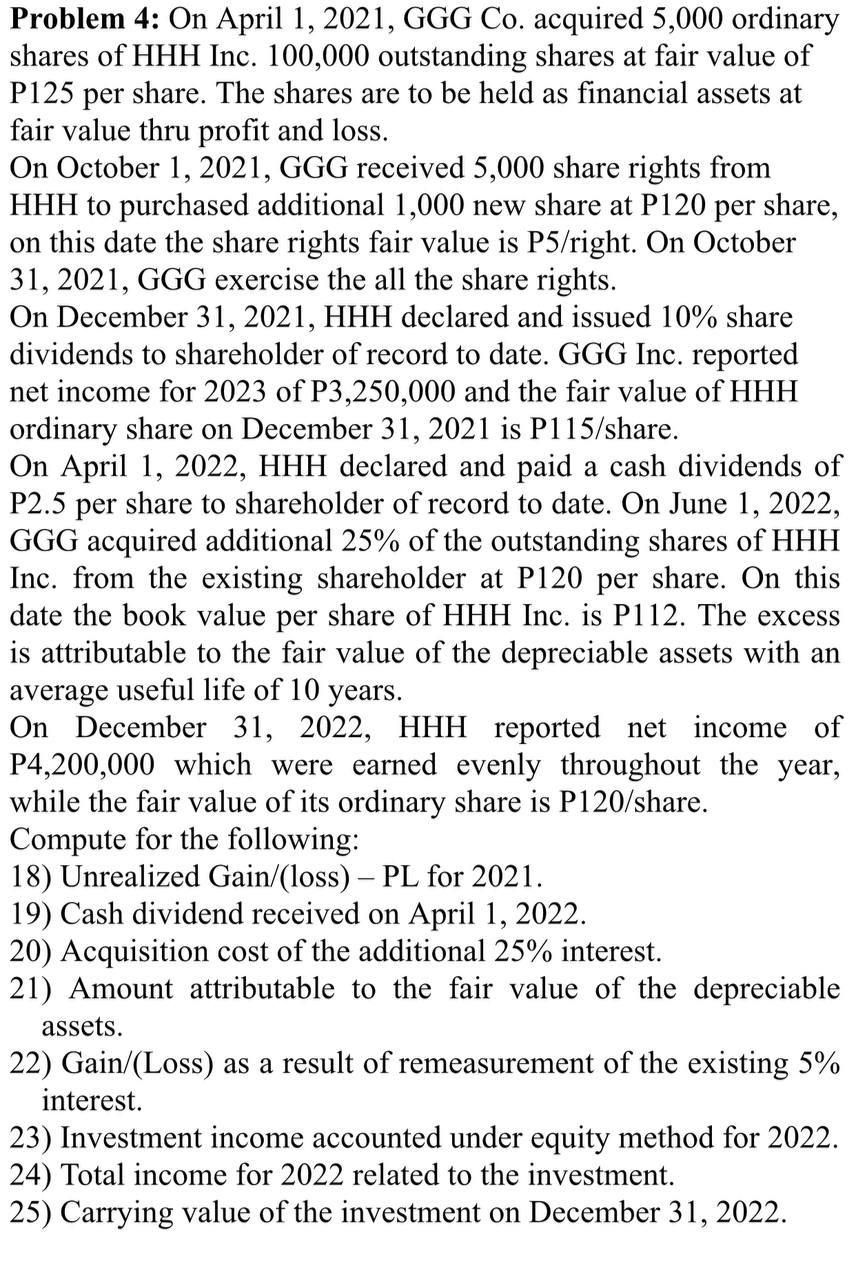

Question: Problem 4 : On April 1 , 2 0 2 1 , GGG Co . acquired 5 , 0 0 0 ordinary shares of HHH

Problem : On April GGG Co acquired ordinary

shares of HHH Inc. outstanding shares at fair value of

P per share. The shares are to be held as financial assets at

fair value thru profit and loss.

On October GGG received share rights from

HHH to purchased additional new share at P per share,

on this date the share rights fair value is right. On October

GGG exercise the all the share rights.

On December HHH declared and issued share

dividends to shareholder of record to date. GGG Inc. reported

net income for of P and the fair value of HHH

ordinary share on December is Pshare

On April HHH declared and paid a cash dividends of

P per share to shareholder of record to date. On June

GGG acquired additional of the outstanding shares of HHH

Inc. from the existing shareholder at P per share. On this

date the book value per share of HHH Inc. is P The excess

is attributable to the fair value of the depreciable assets with an

average useful life of years.

On December HHH reported net income of

P which were earned evenly throughout the year,

while the fair value of its ordinary share is Pshare

Compute for the following:

Unrealized Gainloss PL for

Cash dividend received on April

Acquisition cost of the additional interest.

Amount attributable to the fair value of the depreciable

assets.

GainLoss as a result of remeasurement of the existing

interest.

Investment income accounted under equity method for

Total income for related to the investment.

Carrying value of the investment on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock