Question: PROBLEM 4 ONLY the $10,000 guaranteed plyll year two, the partnership sells an asset (basis t1U,00U, lll laPRet value $15,000) and distributes $5,000 cash to

PROBLEM 4 ONLY

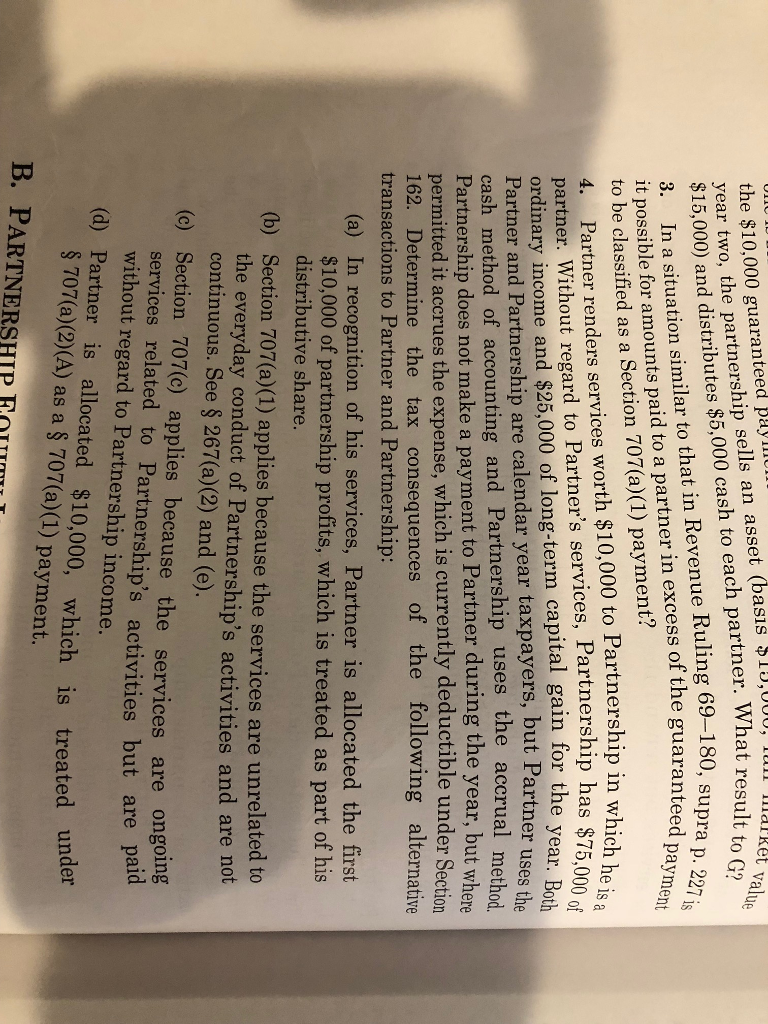

the $10,000 guaranteed plyll year two, the partnership sells an asset (basis t1U,00U, lll laPRet value $15,000) and distributes $5,000 cash to each partner. What res 3. In a situation similar to that in Revenue Ruling 69-180 it possible for amounts paid to a partner in excess of the to be classified as a Section 707(a)(1) payment? , supra p. 227 is partner. Without regard to Partner's services, Partnership has $ ordinary income and $25,000 of long-term capital gain for the vea Partner and Partnership are calendar year taxpayers, but Partner u cash method of accounting and Partnership uses the accrual 15,000 of 4. Partner renders services worth $10,000 to Partnership in which he th uses the method. Partnership does not make a payment to Partner during the year, but where permitted it accrues the expense, which is currently deductible under Section 162. Determine the tax consequences of the following alternative transactions to Partner and Partnership (a) In recognition of his services, Partner is allocated the first $10,000 of partnership profits, which is treated as part of his distributive share. (b) Sectio n 707(a)(1) applies because the services are unrelated to the everyday conduct of Partnership's activities and are not continuous. See 267(a)(2) and (e). (c) Section 707(c) applies because the services are ongoing services related to Partners without regard to Partnership income (d) Partner is allocated $10,000, which is treated 707 (a)(2)(A) as a S 707(a)(1) payment B. PARTNERSHIP OU the $10,000 guaranteed plyll year two, the partnership sells an asset (basis t1U,00U, lll laPRet value $15,000) and distributes $5,000 cash to each partner. What res 3. In a situation similar to that in Revenue Ruling 69-180 it possible for amounts paid to a partner in excess of the to be classified as a Section 707(a)(1) payment? , supra p. 227 is partner. Without regard to Partner's services, Partnership has $ ordinary income and $25,000 of long-term capital gain for the vea Partner and Partnership are calendar year taxpayers, but Partner u cash method of accounting and Partnership uses the accrual 15,000 of 4. Partner renders services worth $10,000 to Partnership in which he th uses the method. Partnership does not make a payment to Partner during the year, but where permitted it accrues the expense, which is currently deductible under Section 162. Determine the tax consequences of the following alternative transactions to Partner and Partnership (a) In recognition of his services, Partner is allocated the first $10,000 of partnership profits, which is treated as part of his distributive share. (b) Sectio n 707(a)(1) applies because the services are unrelated to the everyday conduct of Partnership's activities and are not continuous. See 267(a)(2) and (e). (c) Section 707(c) applies because the services are ongoing services related to Partners without regard to Partnership income (d) Partner is allocated $10,000, which is treated 707 (a)(2)(A) as a S 707(a)(1) payment B. PARTNERSHIP OU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts