Question: Problem 4. P14-13. Stock split--firm Refer to section LG 6 in chapter 14 (25 points) For a stock split shares multiply, par value divides; Total

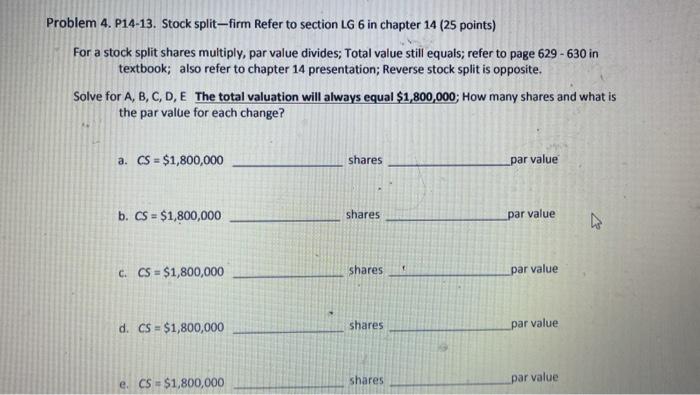

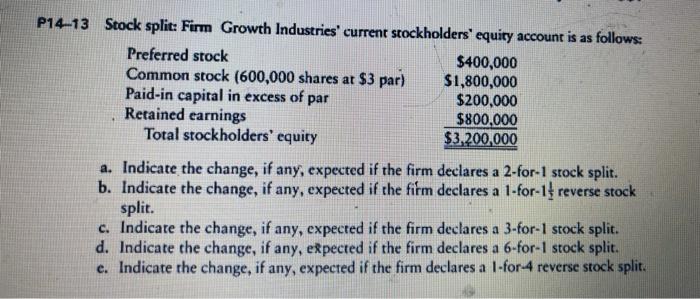

Problem 4. P14-13. Stock split--firm Refer to section LG 6 in chapter 14 (25 points) For a stock split shares multiply, par value divides; Total value still equals; refer to page 629 - 630 in textbook; also refer to chapter 14 presentation; Reverse stock split is opposite. Solve for A, B, C, D, E The total valuation will always equal $1,800,000; How many shares and what is the par value for each change? a. CS = $1,800,000 shares par value b. CS = $1,800,000 shares par value C. CS = $1,800,000 shares 1 par value d. CS = $1,800,000 shares par value e. CS $1,800,000 shares par value P14-13 Stock split: Firm Growth Industries' current stockholders' equity account is as follows: Preferred stock $400,000 Common stock (600,000 shares at $3 par) $1,800,000 Paid-in capital in excess of par $200,000 Retained earnings $800,000 Total stockholders' equity $3,200,000 a. Indicate the change, if any, expected if the firm declares a 2-for-1 stock split. b. Indicate the change, if any, expected if the firm declares a 1-for-14 reverse stock split. c. Indicate the change, if any, expected if the firm declares a 3-for-1 stock split. d. Indicate the change, if any, expected if the firm declares a 6-for-1 stock split. e. Indicate the change, if any, expected if the firm declares a 1-for-4 reverse stock split

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts