Question: Problem 4: Performance Evaluation (11 Points) FBB is a division of a major corporation. Last year the division had total sales of $900,000, a margin

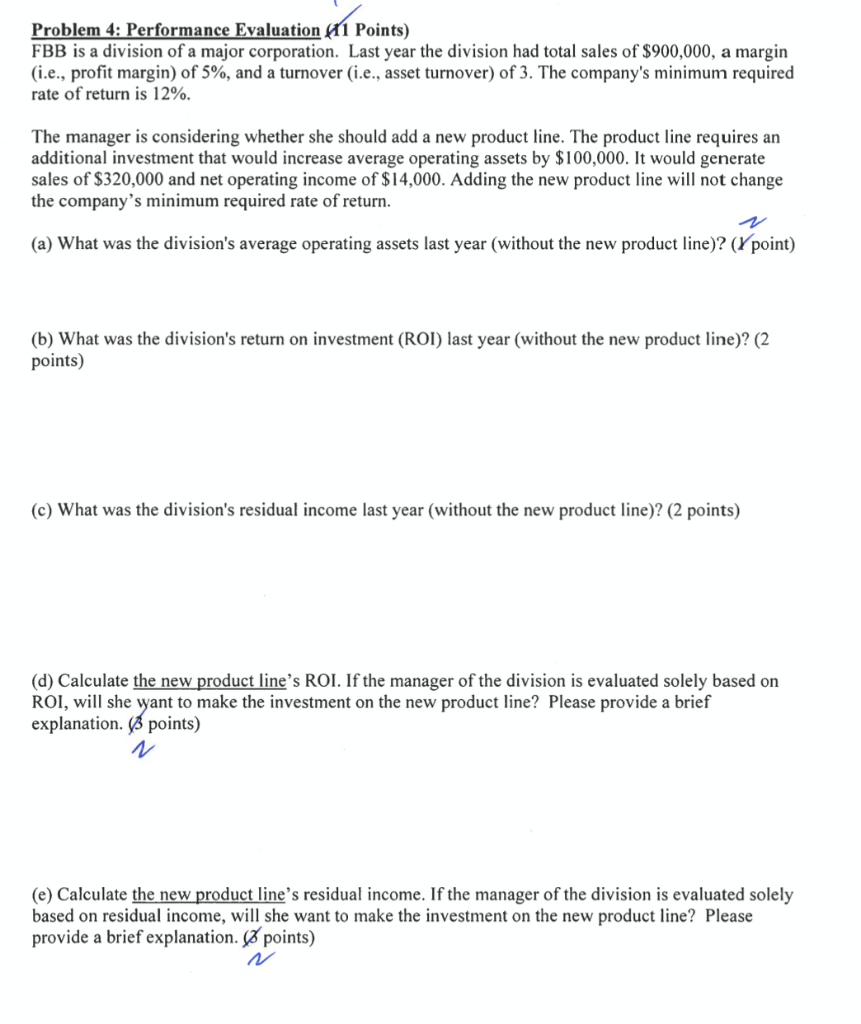

Problem 4: Performance Evaluation (11 Points) FBB is a division of a major corporation. Last year the division had total sales of $900,000, a margin (i.e., profit margin) of 5%, and a turnover (i.e., asset turnover) of 3. The company's minimum required rate of return is 12%. The manager is considering whether she should add a new product line. The product line requires an additional investment that would increase average operating assets by $100,000. It would generate sales of $320,000 and net operating income of $14,000. Adding the new product line will not change the company's minimum required rate of return. (a) What was the division's average operating assets last year (without the new product line)? (Y point) (b) What was the division's return on investment (ROI) last year (without the new product line)? (2 points) (c) What was the division's residual income last year (without the new product line)? (2 points) (d) Calculate the new product line's ROI. If the manager of the division is evaluated solely based on ROI, will she want to make the investment on the new product line? Please provide a brief explanation. $ points) (e) Calculate the new product line's residual income. If the manager of the division is evaluated solely based on residual income, will she want to make the investment on the new product line? Please provide a brief explanation. & points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts