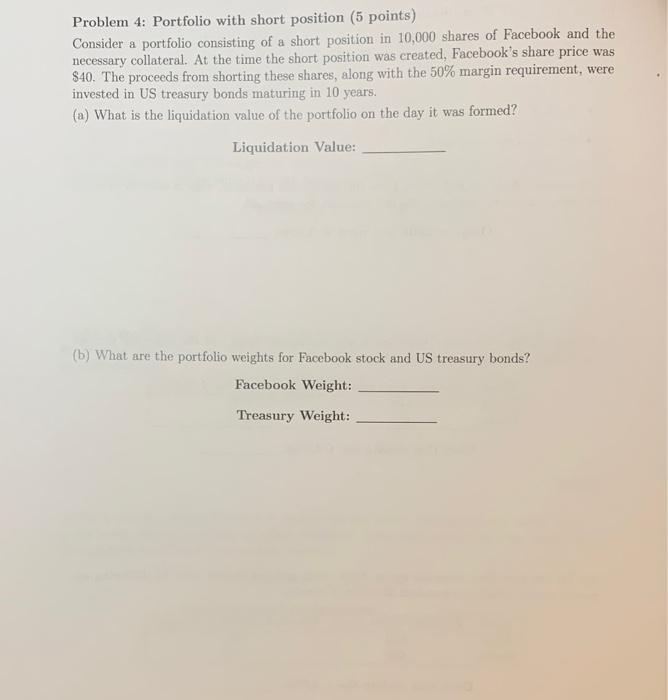

Question: Problem 4: Portfolio with short position (5 points) Consider a portfolio consisting of a short position in 10,000 shares of Facebook and the necessary collateral.

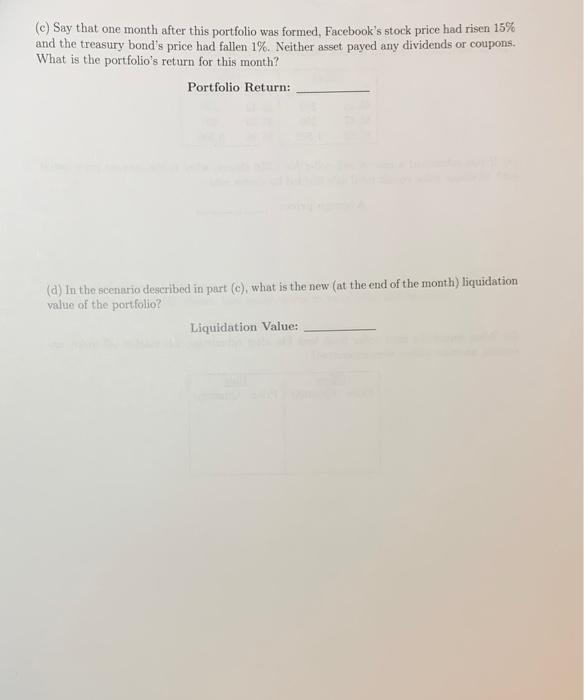

Problem 4: Portfolio with short position (5 points) Consider a portfolio consisting of a short position in 10,000 shares of Facebook and the necessary collateral. At the time the short position was created, Facebook's share price was $40. The proceeds from shorting these shares, along with the 50% margin requirement, were invested in US treasury bonds maturing in 10 years. (a) What is the liquidation value of the portfolio on the day it was formed? Liquidation Value: (b) What are the portfolio weights for Facebook stock and US treasury bonds? Facebook Weight: Treasury Weight: () Say that one month after this portfolio was formed, Facebook's stock price had risen 15% and the treasury bond's price had fallen 1%. Neither asset payed any dividends or coupons. What is the portfolio's return for this month? Portfolio Return: (a) In the scenario described in part (e), what is the new (at the end of the month) liquidation value of the portfolio? Liquidation Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts