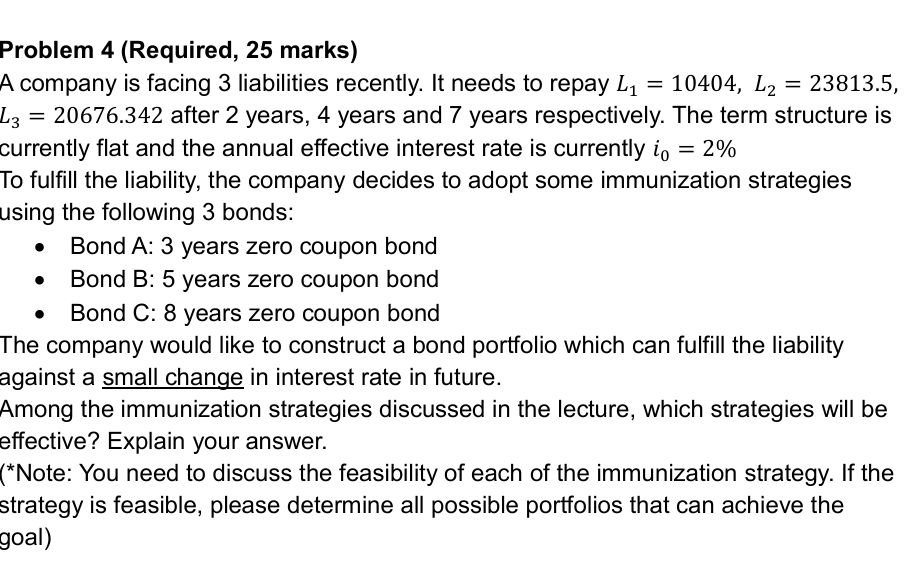

Question: Problem 4 ( Required , 2 5 marks ) A company is facing 3 liabilities recently. It needs to repay ( L _ {

Problem Required marks A company is facing liabilities recently. It needs to repay L L L after years, years and years respectively. The term structure is currently flat and the annual effective interest rate is currently i To fulfill the liability, the company decides to adopt some immunization strategies using the following bonds: Bond A: years zero coupon bond Bond B: years zero coupon bond Bond C: years zero coupon bond The company would like to construct a bond portfolio which can fulfill the liability against a small change in interest rate in future. Among the immunization strategies discussed in the lecture, which strategies will be effective? Explain your answer. Note: You need to discuss the feasibility of each of the immunization strategy. If the strategy is feasible, please determine all possible portfolios that can achieve the goal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock