Question: Problem 4 (Required, 30 marks) A company needs to pay L1=$55435.89 after 3 years and pay another L2= $14105.99 after 10 years. To fulfil the

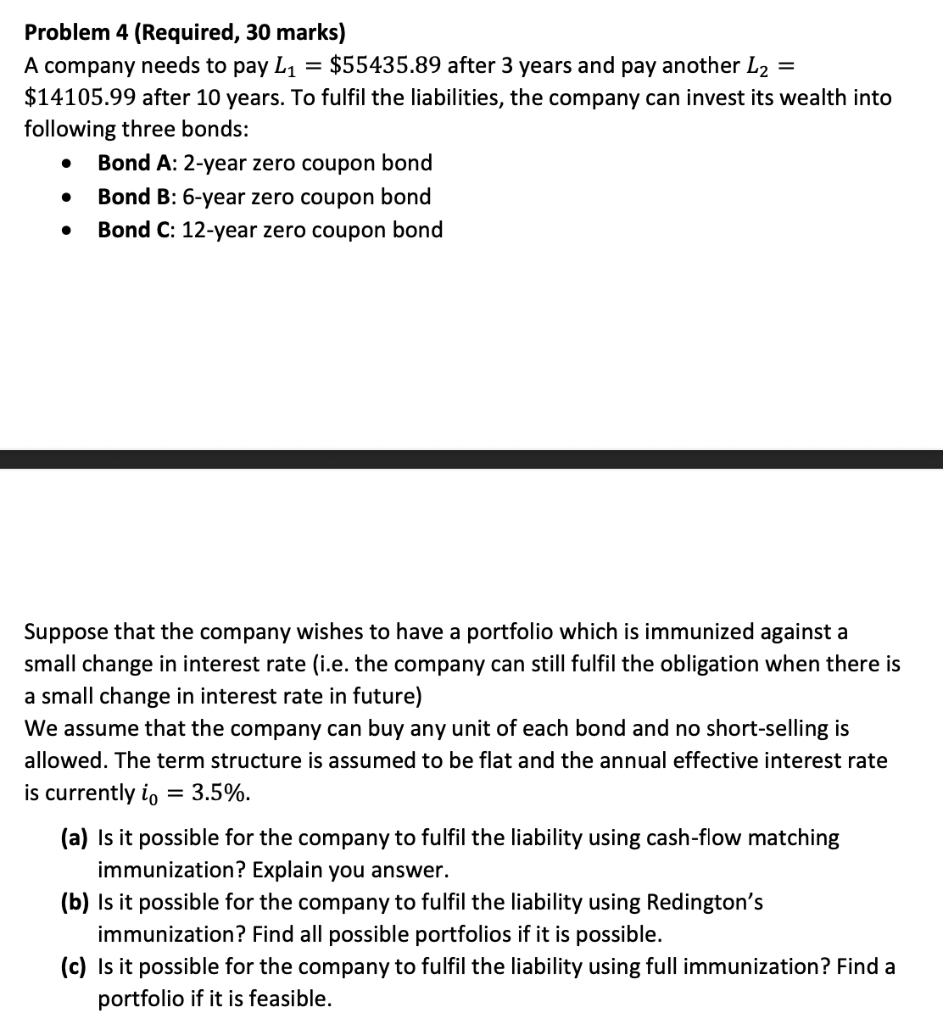

Problem 4 (Required, 30 marks) A company needs to pay L1=$55435.89 after 3 years and pay another L2= $14105.99 after 10 years. To fulfil the liabilities, the company can invest its wealth into following three bonds: - Bond A: 2-year zero coupon bond - Bond B: 6-year zero coupon bond - Bond C: 12-year zero coupon bond Suppose that the company wishes to have a portfolio which is immunized against a small change in interest rate (i.e. the company can still fulfil the obligation when there is a small change in interest rate in future) We assume that the company can buy any unit of each bond and no short-selling is allowed. The term structure is assumed to be flat and the annual effective interest rate is currently i0=3.5%. (a) Is it possible for the company to fulfil the liability using cash-flow matching immunization? Explain you answer. (b) Is it possible for the company to fulfil the liability using Redington's immunization? Find all possible portfolios if it is possible. (c) Is it possible for the company to fulfil the liability using full immunization? Find a portfolio if it is feasible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts