Question: Problem #4 - Scenario A You are given the following balance sheet values of a hypothetical bank (OUR Bank) at t=0. The OUR Bank uses

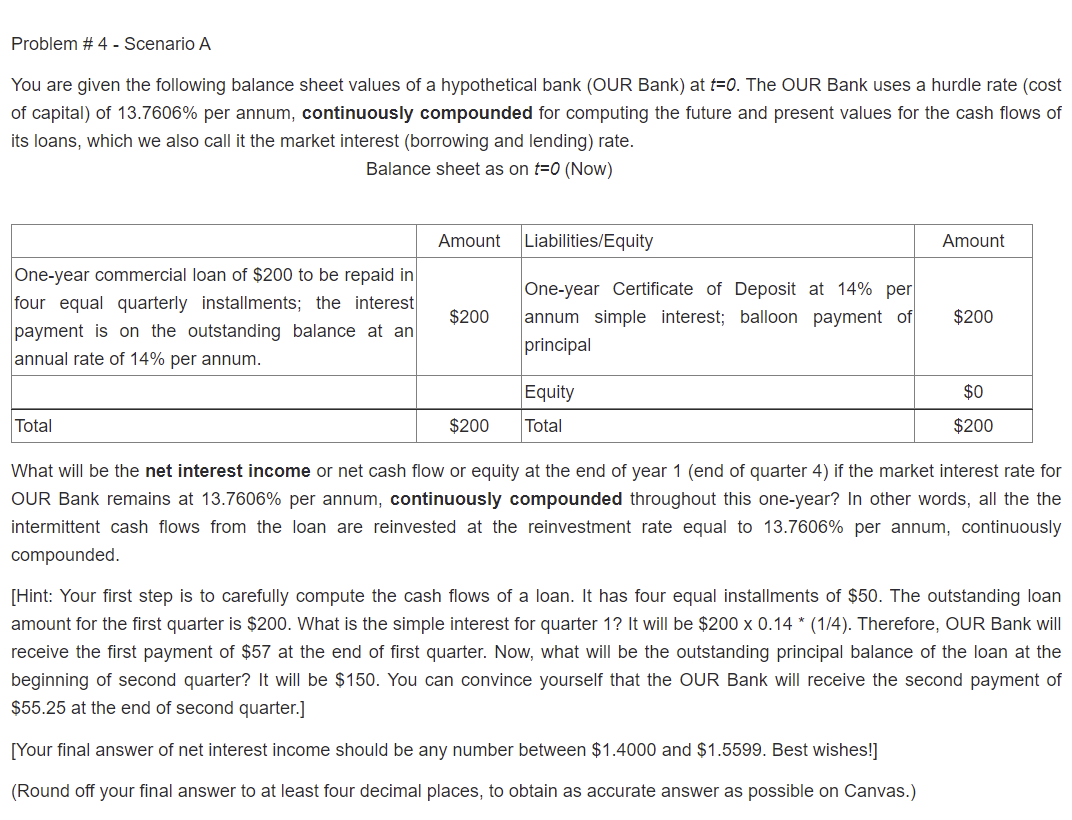

Problem #4 - Scenario A You are given the following balance sheet values of a hypothetical bank (OUR Bank) at t=0. The OUR Bank uses a hurdle rate (cost of capital) of 13.7606% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Amount Liabilities/Equity Amount One-year commercial loan of $200 to be repaid in four equal quarterly installments; the interest payment is on the outstanding balance at an annual rate of 14% per annum. $200 One-year Certificate of Deposit at 14% per annum simple interest; balloon payment of principal $200 Equity $0 Total $200 Total $200 What will be the net interest income or net cash flow or equity at the end of year 1 (end of quarter 4) if the market interest rate for OUR Bank remains at 13.7606% per annum, continuously compounded throughout this one-year? In other words, all the the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 13.7606% per annum, continuously compounded [Hint: Your first step is to carefully compute the cash flows of a loan. It has four equal installments of $50. The outstanding loan amount for the first quarter is $200. What is the simple interest for quarter 1? It will be $200 x 0.14 * (1/4). Therefore, OUR Bank will receive the first payment of $57 at the end of first quarter. Now, what will be the outstanding principal balance of the loan at the beginning of second quarter? It will be $150. You can convince yourself that the OUR Bank will receive the second payment of $55.25 at the end of second quarter.] [Your final answer of net interest income should be any number between $1.4000 and $1.5599. Best wishes!] (Round off your final answer to at least four decimal places, to obtain as accurate answer as possible on Canvas.) Problem #4 - Scenario A You are given the following balance sheet values of a hypothetical bank (OUR Bank) at t=0. The OUR Bank uses a hurdle rate (cost of capital) of 13.7606% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Amount Liabilities/Equity Amount One-year commercial loan of $200 to be repaid in four equal quarterly installments; the interest payment is on the outstanding balance at an annual rate of 14% per annum. $200 One-year Certificate of Deposit at 14% per annum simple interest; balloon payment of principal $200 Equity $0 Total $200 Total $200 What will be the net interest income or net cash flow or equity at the end of year 1 (end of quarter 4) if the market interest rate for OUR Bank remains at 13.7606% per annum, continuously compounded throughout this one-year? In other words, all the the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 13.7606% per annum, continuously compounded [Hint: Your first step is to carefully compute the cash flows of a loan. It has four equal installments of $50. The outstanding loan amount for the first quarter is $200. What is the simple interest for quarter 1? It will be $200 x 0.14 * (1/4). Therefore, OUR Bank will receive the first payment of $57 at the end of first quarter. Now, what will be the outstanding principal balance of the loan at the beginning of second quarter? It will be $150. You can convince yourself that the OUR Bank will receive the second payment of $55.25 at the end of second quarter.] [Your final answer of net interest income should be any number between $1.4000 and $1.5599. Best wishes!] (Round off your final answer to at least four decimal places, to obtain as accurate answer as possible on Canvas.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts