Question: Problem 4 Suppose that the current value of one share of DIA is USD 290. Assume that the annual rates of interest in USD and

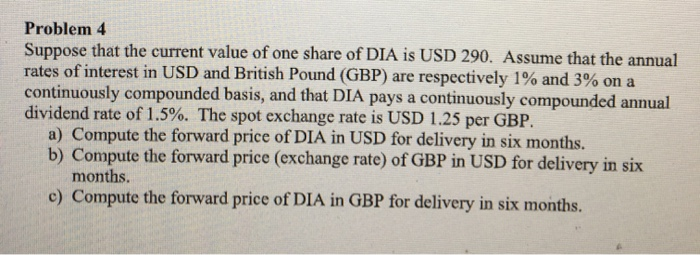

Problem 4 Suppose that the current value of one share of DIA is USD 290. Assume that the annual rates of interest in USD and British Pound (GBP) are respectively 1% and 3% on a continuously compounded basis, and that DIA pays a continuously compounded annual dividend rate of 1.5%. The spot exchange rate is USD 1.25 per GBP. a) Compute the forward price of DIA in USD for delivery in six months. b) Compute the forward price (exchange rate) of GBP in USD for delivery in six months. c) Compute the forward price of DIA in GBP for delivery in six months

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock