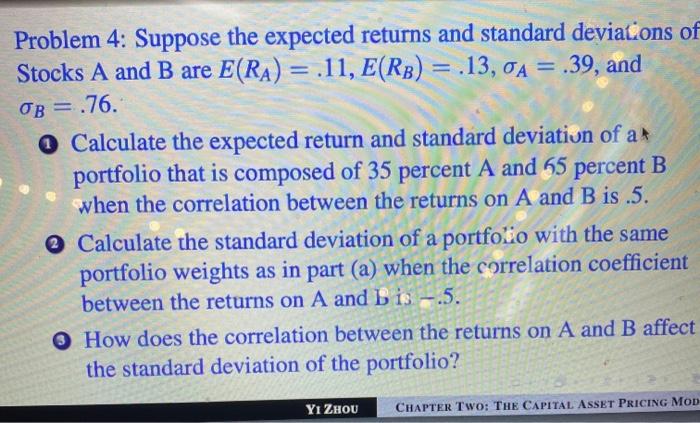

Question: Problem 4: Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .11, E(RB) = .13, 0A = .39, and

Problem 4: Suppose the expected returns and standard deviations of Stocks A and B are E(RA) = .11, E(RB) = .13, 0A = .39, and OB= .76. O Calculate the expected return and standard deviation of a portfolio that is composed of 35 percent A and 65 percent B when the correlation between the returns on A and B is .5. @ Calculate the standard deviation of a portfolio with the same portfolio weights as in part (a) when the correlation coefficient between the returns on A and B is -.5. How does the correlation between the returns on A and B affect the standard deviation of the portfolio? YI ZHOU CHAPTER TWO: THE CAPITAL ASSET PRICING MOD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts