Question: Problem 4 (Textbook Reference: P2-4)- Demonstrate job costing Log Cabin Homes, Inc. uses its records showed inventories as follows: a job cost system to account

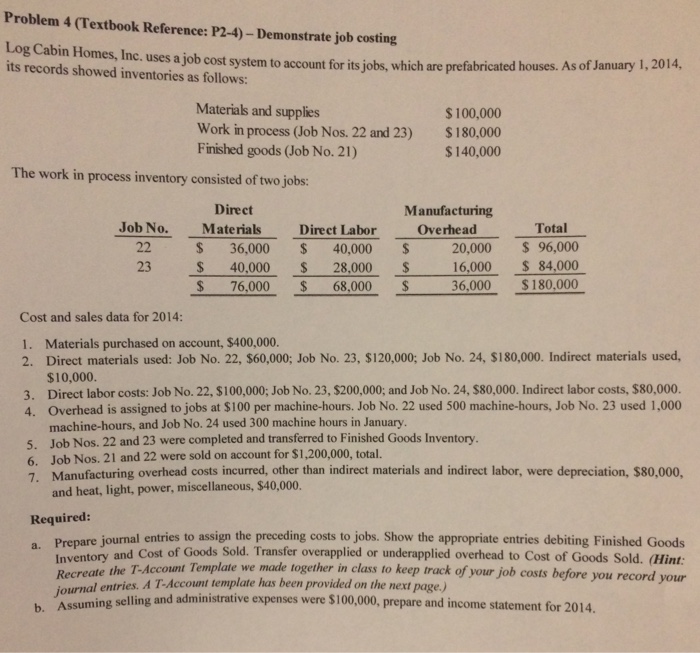

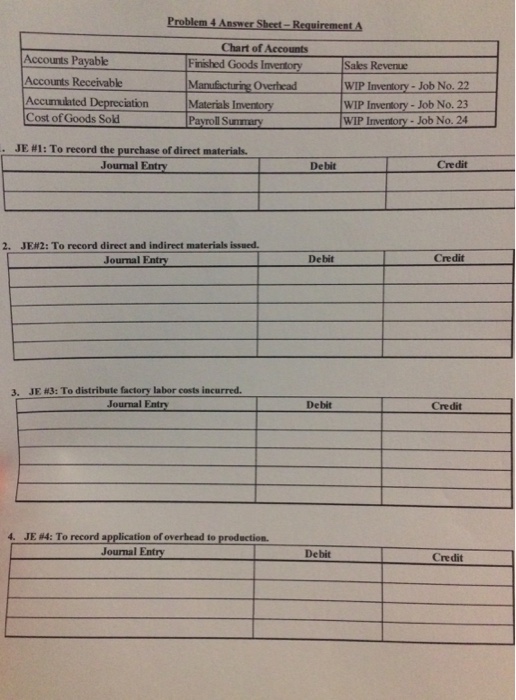

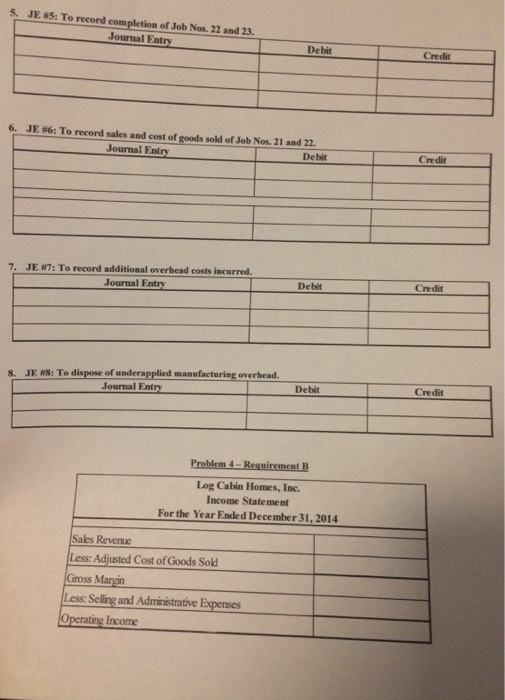

Problem 4 (Textbook Reference: P2-4)- Demonstrate job costing Log Cabin Homes, Inc. uses its records showed inventories as follows: a job cost system to account for its jobs, which are prefabricated houses. As of January 1,2014, Materials and supplies S100,000 Work in process (Job Nos. 22 and 23) 180,000 Finished goods (Job No. 21) $ 140,000 The work in process inventory consisted of two jobs: Direct Mate rials Manufacturing Overhead Job No. Direet Labor Total S 36,000 40,000 20,000 $ 96,000 16,000 84,000 23 S 40,000 76,000 28,000 $ 68,000 $ Cost and sales data for 2014: 1. Materials purchased on account, $400,000. 2. Direct materials used: Job No. 22, $60,000; Job No. 23, $120,000; Job No. 24, $180,000. Indirect materials used, $10,000. Direct labor costs: Job No. 22, $100,000; Job No. 23, $200,000; and Job No. 24, $80,000. Indirect labor costs, $80,000. machine-hours, and Job No. 24 used 300 machine hours in January Job Nos. 21 and 22 were sold on account for $1,200,000, total. and heat, light, power, miscellaneous, $40,000. Prepare journal entries to assign the preceding costs to jobs. Show the appropriate entries debiting Finished Goods 3. 4. Overhead is assigned to jobs at $100 per machine-hours. Job No. 22 used 500 machine-hours, Job No. 23 used 1,000 5. Job Nos. 22 and 23 were completed and transferred to Finished Goods Inventory. 7. Manufacturing overhead costs incurred, other than indirect materials and indirect labor, were depreciation, $80,000, Required: and Cost of Goods Sold. Transfer overapplied or underapplied overhead to Cost of Goods Sold. (Hint Recreate the T-Account Template we made together in class to keep track of your job costs before you record your journal entries. A T-Account template has been provided on the next page) b.Assuming selling and administrative expenses were 5100,000, prepare and income statement for 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts