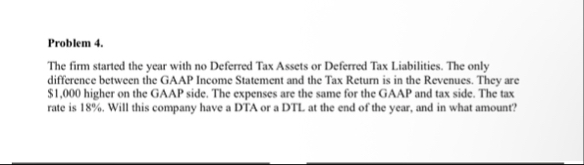

Question: Problem 4 . The firm started the year with no Deferred Tax Assets or Deferred Tax Liabilities. The only difference between the GAAP Income Statement

Problem

The firm started the year with no Deferred Tax Assets or Deferred Tax Liabilities. The only difference between the GAAP Income Statement and the Tax Return is in the Revenues. They are $ higher on the GAAP side. The expenses are the same for the GAAP and tax side. The tax rate is Will this company have a DTA or a DTL at the end of the year, and in what amount?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock