Question: Problem 4: TIPS (5 points) A 2-year TIPS with annual coupon payments, a coupon rate of 1%, and a face value of $100 has a

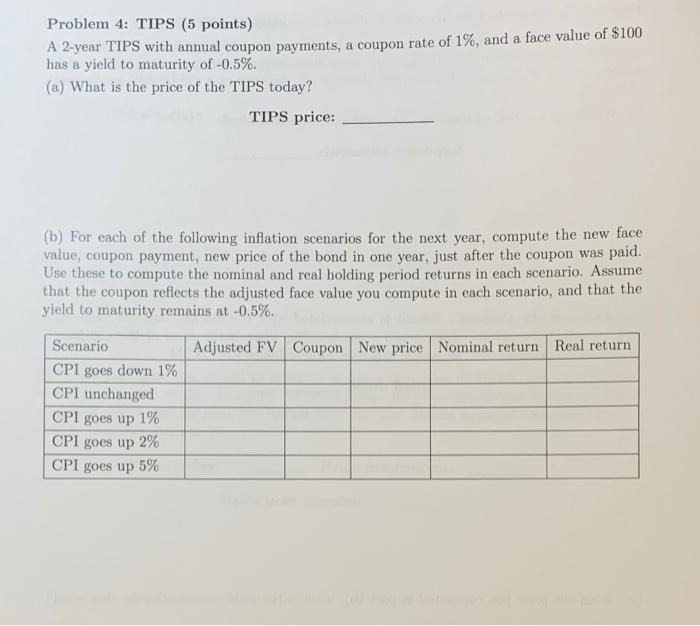

Problem 4: TIPS (5 points) A 2-year TIPS with annual coupon payments, a coupon rate of 1%, and a face value of $100 has a yield to maturity of -0.5%. (a) What is the price of the TIPS today? TIPS price: (b) For each of the following inflation scenarios for the next year, compute the new face value, coupon payment, new price of the bond in one year, just after the coupon was paid. Use these to compute the nominal and real holding period returns in each scenario. Assume that the coupon reflects the adjusted face value you compute in each scenario, and that the yield to maturity remains at -0.5%. Adjusted FV Coupon New price Nominal return Real return Scenario CPI goes down 1% CPI unchanged CPI goes up 1% CPI goes up 2% CPI goes up 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts