Question: Problem 4 (True/False) A. This model is used to determine the required return on an asset, which is based on the proposition that any assets

Problem 4 (True/False)

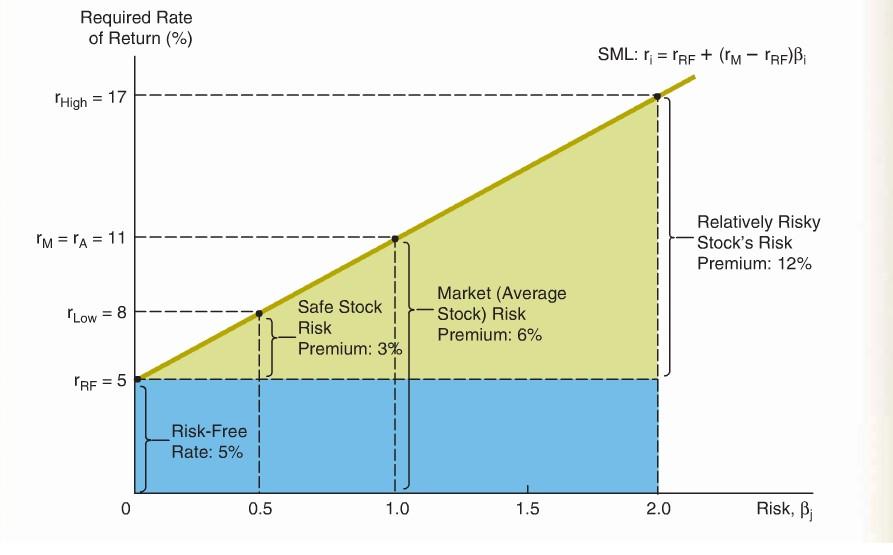

A. This model is used to determine the required return on an asset, which is based on the proposition that any assets return should be equal to the risk-free return plus a risk premium that reflects the assets nondiversifiable risk.

B. The formula serves also as a representation of the Security Market Line (SML) that shows the relationship between risk as measured by beta and the required rate of return for individual securities.

C. The (rm rf) in the formula represents the extent to which the returns on a given stock move with the stock market.

D. The represents the systematic risk that can be diversified away.

E. The market is represented here as having a Beta of 1 and measures the volatility in stock movements relative to the market.

F. The steepness of the line will increase if the investor is risk-averse.

Required Rate of Return (%) SML: r; = PRE + ('M - PRP) B: 'High = 17 I I'm = PA = 11 Relatively Risky Stock's Risk Premium: 12% 1 1 1 1 1 "Low = 8 Market (Average Stock) Risk Premium: 6% Safe Stock Risk Premium: 3% 'RF = 5 Risk-Free Rate: 5% 0 0.5 1.0 1.5 2.0 Risk, B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts