Question: Problem 4): Two projects being considered are mutually exclusive and have the following projected cash flows as fallows, (cost of capital for risky projects is

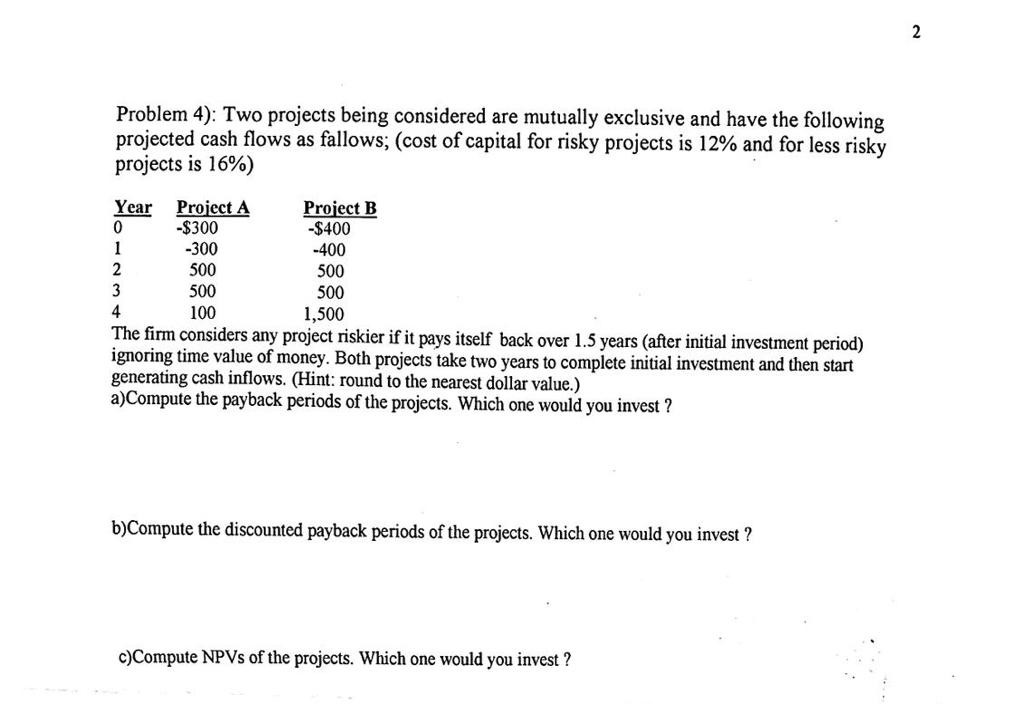

Problem 4): Two projects being considered are mutually exclusive and have the following projected cash flows as fallows, (cost of capital for risky projects is 12% and for less risky projects is 16%) Year Project A Project B -$300 -300 500 500 100 $400 400 500 500 1,500 4 The firm considers any project riskier if it pays itself back over 1.5 years (after initial investment period) ignoring time value of money. Both projects take two years to complete initial investment and then start generating cash inflows. (Hint: round to the nearest dollar value.) a)Compute the payback periods of the projects. Which one would you invest? b)Compute the discounted payback periods of the projects. Which one would you invest? c)Compute NPVs of the projects. Which one would you invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts