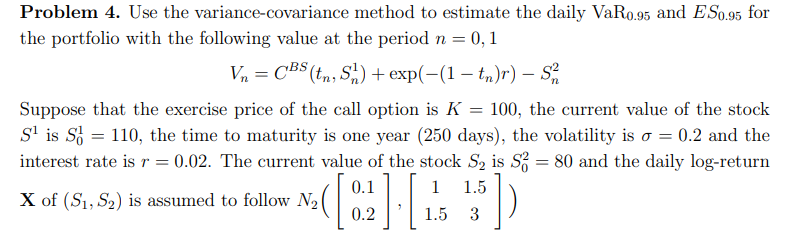

Question: Problem 4. Use the variance-covariance method to estimate the daily VaRo.95 and ES0.95 for the portfolio with the following value at the period n =

Problem 4. Use the variance-covariance method to estimate the daily VaRo.95 and ES0.95 for the portfolio with the following value at the period n = 0,1 Vn=CBS(tn, St) + exp(-(1 tn)r) - SA Suppose that the exercise price of the call option is K 100, the current value of the stock Sl is S= 110, the time to maturity is one year (250 days), the volatility is o = 0.2 and the interest rate is r = 0.02. The current value of the stock S2 is Sz = 80 and the daily log-return 0.1 1.5 X of (S1, S2) is assumed to follow N2 0.2 1.5 3 = 1 Problem 4. Use the variance-covariance method to estimate the daily VaRo.95 and ES0.95 for the portfolio with the following value at the period n = 0,1 Vn=CBS(tn, St) + exp(-(1 tn)r) - SA Suppose that the exercise price of the call option is K 100, the current value of the stock Sl is S= 110, the time to maturity is one year (250 days), the volatility is o = 0.2 and the interest rate is r = 0.02. The current value of the stock S2 is Sz = 80 and the daily log-return 0.1 1.5 X of (S1, S2) is assumed to follow N2 0.2 1.5 3 = 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts