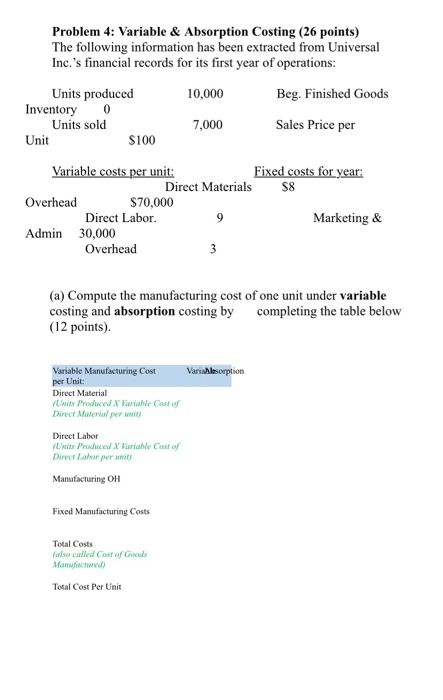

Question: Problem 4: Variable & Absorption Costing (26 points) The following information has been extracted from Universal Inc.'s financial records for its first year of operations:

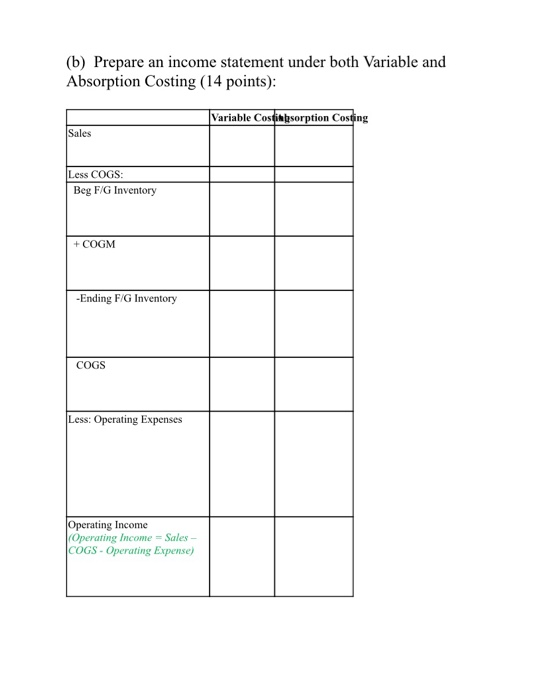

Problem 4: Variable & Absorption Costing (26 points) The following information has been extracted from Universal Inc.'s financial records for its first year of operations: 10,000 Beg. Finished Goods Units produced Inventory 0 Units sold Unit $100 7,000 Sales Price per Variable costs per unit: Fixed costs for year: Direct Materials $8 Overhead $70,000 Direct Labor. Marketing & Admin 30,000 Overhead 9 (a) Compute the manufacturing cost of one unit under variable costing and absorption costing by completing the table below (12 points) Varis.Alsorption Variable Manufacturing Cost per Unit: Direct Material (Units Produced X Variable Cost of Direct Material per il Direct Labor (Units Produced X Variable Cost of Dinner labor per unit) Manufacturing OH Fixed Manufacturing Costs Total Costs (also called Cost of Goods Manufactured) Total Cost Per Unit (b) Prepare an income statement under both Variable and Absorption Costing (14 points): Variable Costik sorption Costing Sales Less COGS: Beg F/G Inventory + COGM -Ending F/G Inventory COGS Less: Operating Expenses Operating Income Operating Income = Sales - COGS - Operating Expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts