Question: Problem 4. You are interested in pricing and hedging a European call option on a stock using a two-period binomial model with notation and set-up

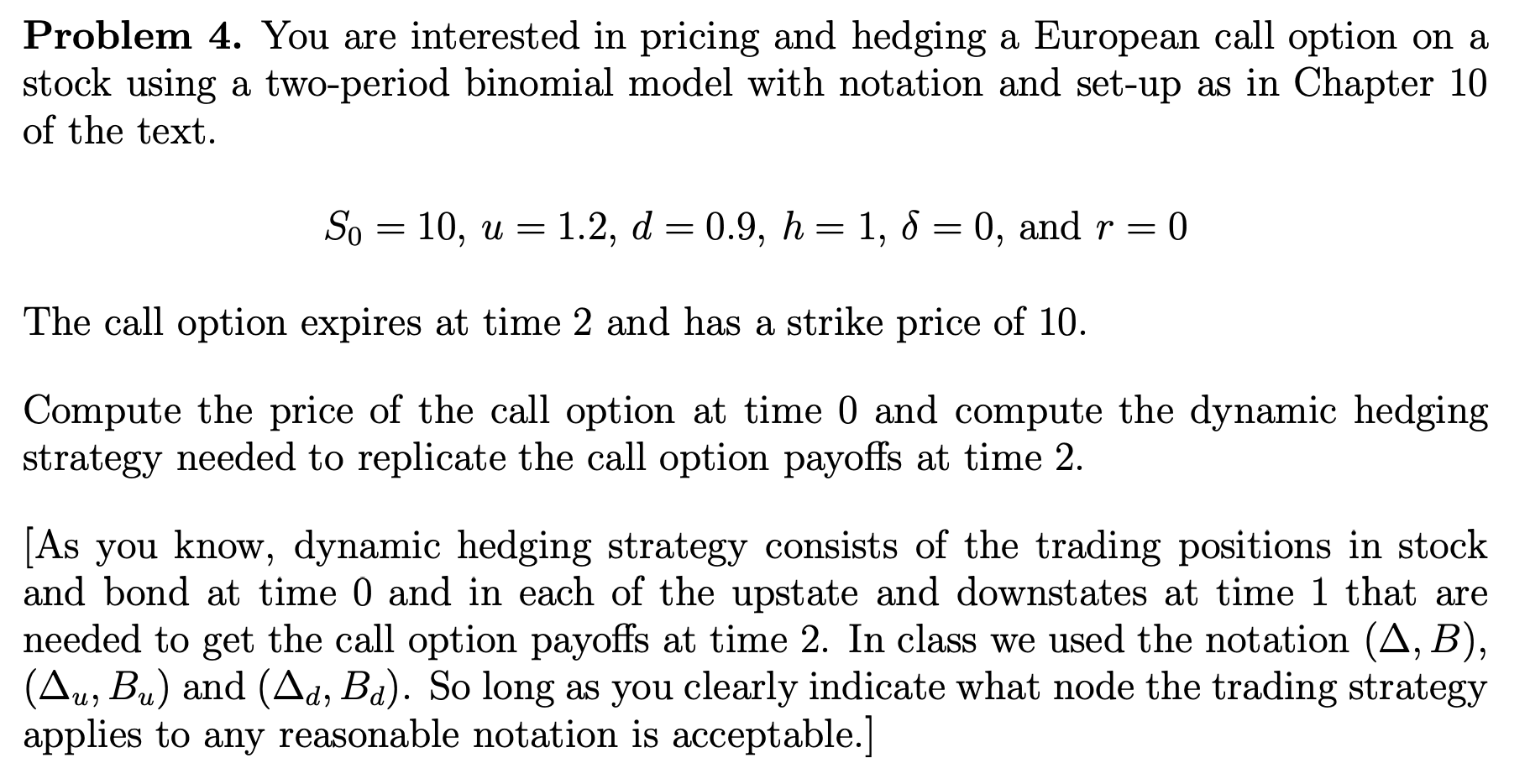

Problem 4. You are interested in pricing and hedging a European call option on a stock using a two-period binomial model with notation and set-up as in Chapter 10 of the text. So = 10, u = 1.2, d=0.9, h=1,= 0, and r = 0 The call option expires at time 2 and has a strike price of 10. Compute the price of the call option at time 0 and compute the dynamic hedging strategy needed to replicate the call option payoffs at time 2. [As you know, dynamic hedging strategy consists of the trading positions in stock and bond at time 0 and in each of the upstate and downstates at time 1 that are needed to get the call option payoffs at time 2. In class we used the notation (A,B), (Au, Bu) and (Ad, Bd). So long as you clearly indicate what node the trading strategy applies to any reasonable notation is acceptable. Problem 4. You are interested in pricing and hedging a European call option on a stock using a two-period binomial model with notation and set-up as in Chapter 10 of the text. So = 10, u = 1.2, d=0.9, h=1,= 0, and r = 0 The call option expires at time 2 and has a strike price of 10. Compute the price of the call option at time 0 and compute the dynamic hedging strategy needed to replicate the call option payoffs at time 2. [As you know, dynamic hedging strategy consists of the trading positions in stock and bond at time 0 and in each of the upstate and downstates at time 1 that are needed to get the call option payoffs at time 2. In class we used the notation (A,B), (Au, Bu) and (Ad, Bd). So long as you clearly indicate what node the trading strategy applies to any reasonable notation is acceptable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts