Question: Problem #4 You have been asked to assess whether it makes sense for this particular company to invest in a new project or not (see

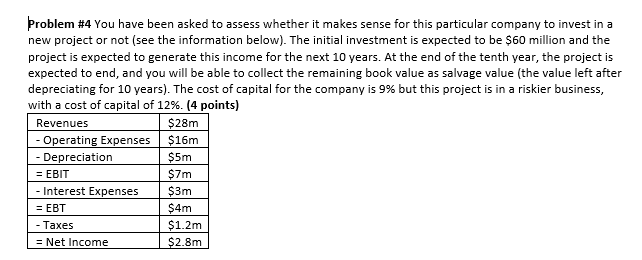

Problem #4 You have been asked to assess whether it makes sense for this particular company to invest in a new project or not (see the information below). The initial investment is expected to be $60 million and the project is expected to generate this income for the next 10 years. At the end of the tenth year, the project is expected to end, and you will be able to collect the remaining book value as salvage value (the value left after depreciating for 10 years). The cost of capital for the company is 9% but this project is in a riskier business, with a cost of capital of 12%. (4 points) Revenues $28m - Operating Expenses $16m - Depreciation $5m = EBIT $7m - Interest Expenses $3m = EBT $4m - Taxes $1.2m = Net Income $2.8m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts