Question: Problem 4 Your client requests you to evaluate two different pump systems for a facility. Assume an interest rate of 8% per year and each

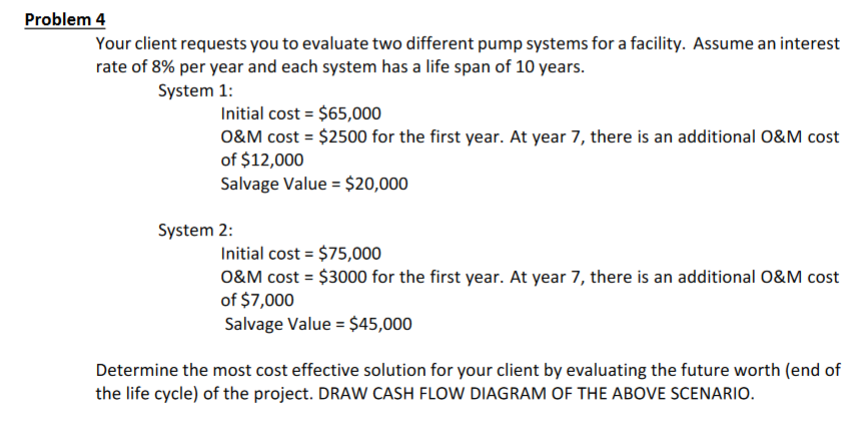

Problem 4 Your client requests you to evaluate two different pump systems for a facility. Assume an interest rate of 8% per year and each system has a life span of 10 years. System 1: Initial cost = $65,000 O&M cost = $2500 for the first year. At year 7, there is an additional O&M cost of $12,000 Salvage Value = $20,000 System 2: Initial cost = $75,000 O&M cost = $3000 for the first year. At year 7, there is an additional O&M cost of $7,000 Salvage Value = $45,000 Determine the most cost effective solution for your client by evaluating the future worth (end of the life cycle) of the project. DRAW CASH FLOW DIAGRAM OF THE ABOVE SCENARIO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts