Question: Problem 4-05A a-g (Part Level Submission) (Video) Pharoah Clark opened Pharoah's Cleaning Service on July 1, 2020. During July, the following transactions were completed. July

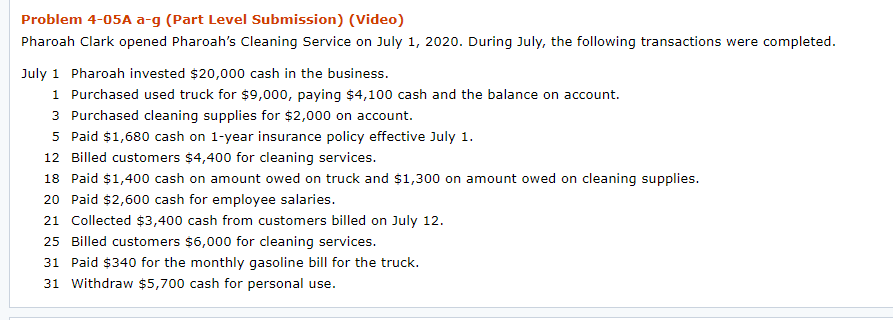

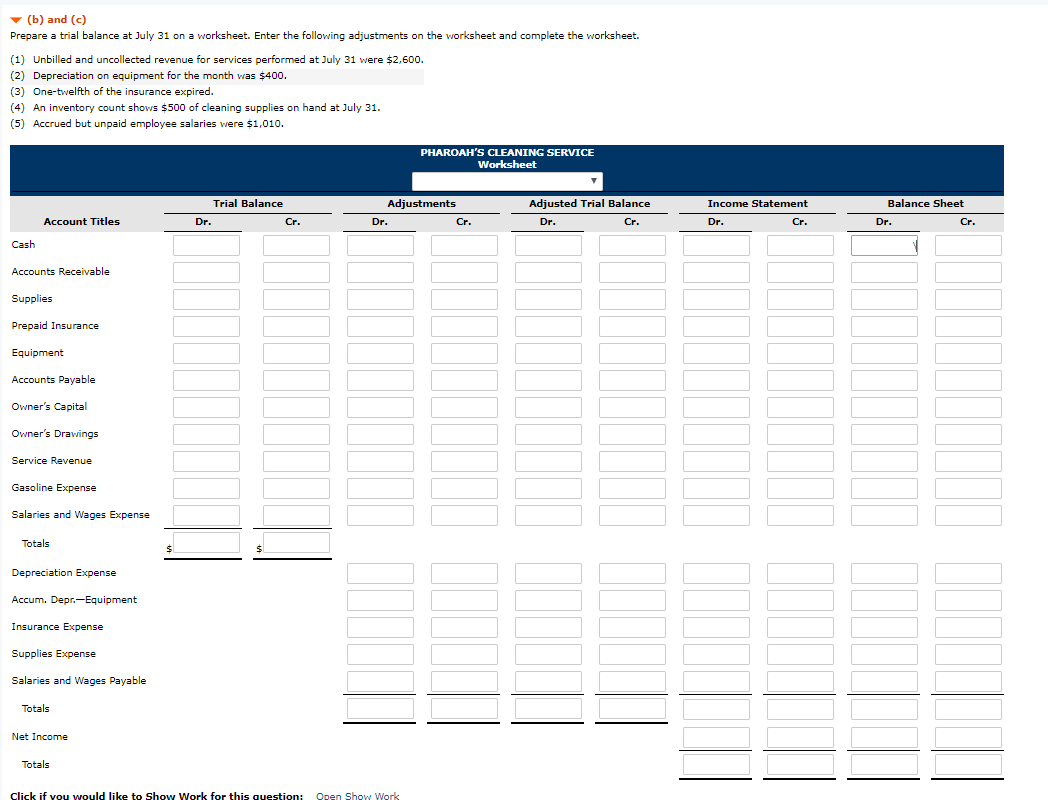

Problem 4-05A a-g (Part Level Submission) (Video) Pharoah Clark opened Pharoah's Cleaning Service on July 1, 2020. During July, the following transactions were completed. July 1 Pharoah invested $20,000 cash in the business. 1 Purchased used truck for $9,000, paying $4,100 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account. 5 Paid $1,680 cash on 1-year insurance policy effective July 1. 12 Billed customers $4,400 for cleaning services. 18 Paid $1,400 cash on amount owed on truck and $1,300 on amount owed on cleaning supplies. 20 Paid $2,600 cash for employee salaries. 21 Collected $3,400 cash from customers billed on July 12. 25 Billed customers $6,000 for cleaning services. 31 Paid $340 for the monthly gasoline bill for the truck. 31 Withdraw $5,700 cash for personal use. (b) and (c) Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 were $2,600. (2) Depreciation on equipment for the month was $400. (3) One-twelfth of the insurance expired. (4) An inventory count shows $500 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $1,010. PHAROAH'S CLEANING SERVICE Worksheet Balance Sheet Trial Balance Dr. Adjustments Dr. Cr. Adjusted Trial Balance Dr. Income Statement Dr. Account Titles Dr. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr.-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals Net Income Totals click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts