Question: Problem 4.1. Joe has decided to save $10,000 each year for his retirement. His first saving will be deposited into the bank one year from

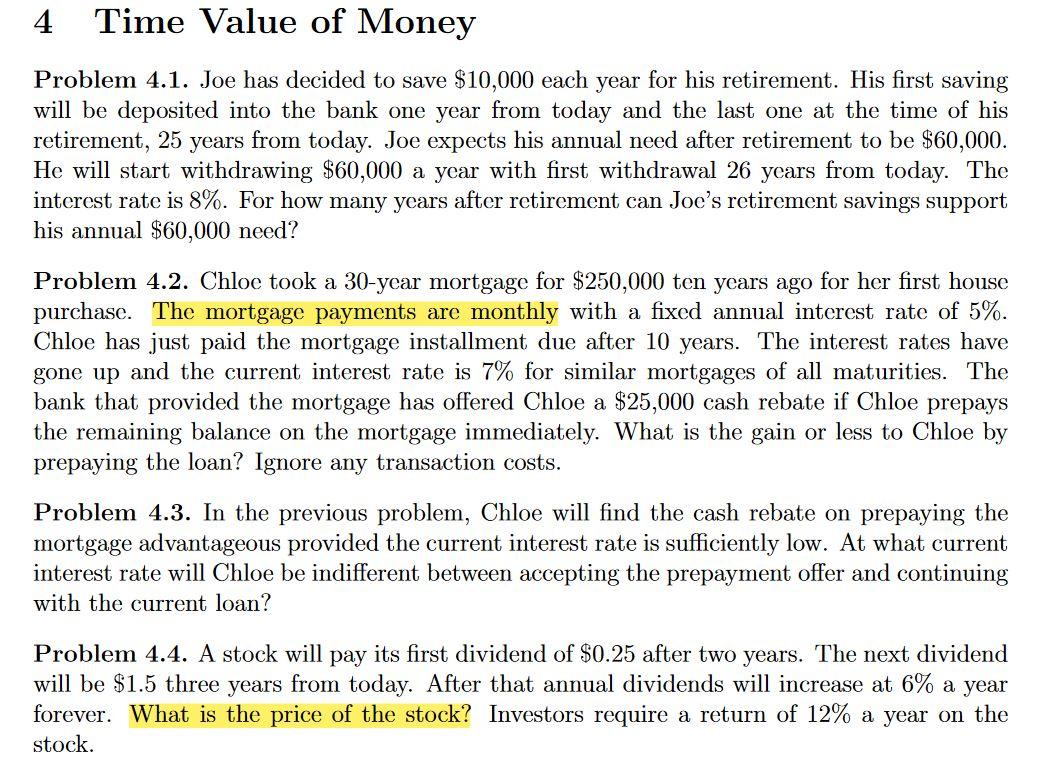

Problem 4.1. Joe has decided to save $10,000 each year for his retirement. His first saving will be deposited into the bank one year from today and the last one at the time of his retirement, 25 years from today. Joe expects his annual need after retirement to be $60,000. He will start withdrawing $60,000 a year with first withdrawal 26 years from today. The interest rate is 8%. For how many years after retirement can Joe's retirement savings support his annual $60,000 need? Problem 4.2. Chloe took a 30-year mortgage for $250,000 ten years ago for her first house purchase. The mortgage payments are monthly with a fixed annual interest rate of 5%. Chloe has just paid the mortgage installment due after 10 years. The interest rates have gone up and the current interest rate is 7% for similar mortgages of all maturities. The bank that provided the mortgage has offered Chloe a $25,000 cash rebate if Chloe prepays the remaining balance on the mortgage immediately. What is the gain or less to Chloe by prepaying the loan? Ignore any transaction costs. Problem 4.3. In the previous problem, Chloe will find the cash rebate on prepaying the mortgage advantageous provided the current interest rate is sufficiently low. At what current interest rate will Chloe be indifferent between accepting the prepayment offer and continuing with the current loan? Problem 4.4. A stock will pay its first dividend of $0.25 after two years. The next dividend will be $1.5 three years from today. After that annual dividends will increase at 6% a year forever. What is the price of the stock? Investors require a return of 12% a year on the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts