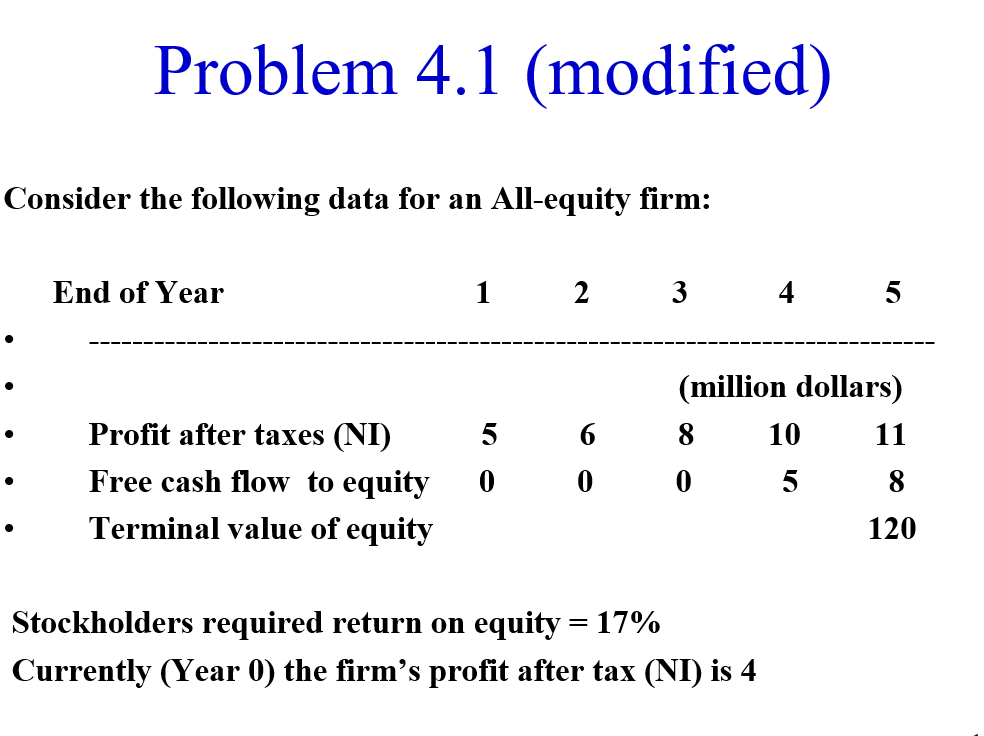

Question: Problem 4.1 (modified) Consider the following data for an All-equity firm: End of Year 1 2 3 4 5 5 Profit after taxes (NI) Free

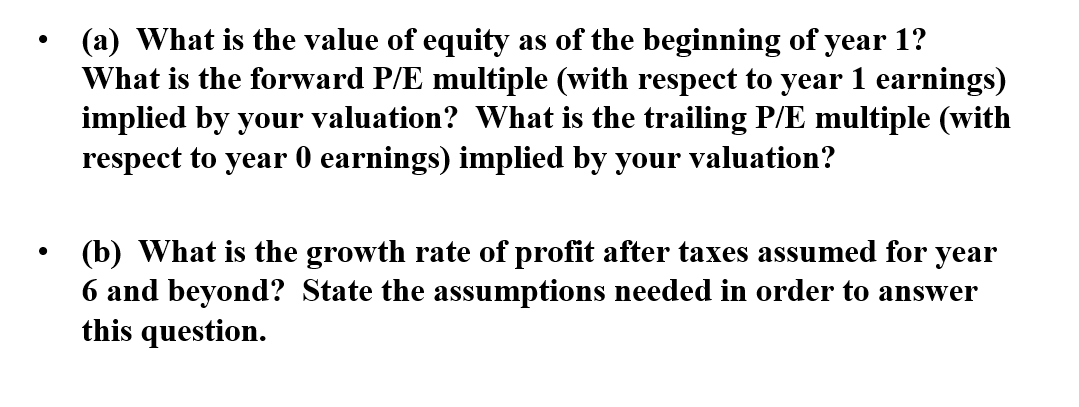

Problem 4.1 (modified) Consider the following data for an All-equity firm: End of Year 1 2 3 4 5 5 Profit after taxes (NI) Free cash flow to equity Terminal value of equity (million dollars) 6 8 10 11 0 0 5 8 0 120 Stockholders required return on equity = 17% Currently (Year 0) the firm's profit after tax (NI) is 4 (a) What is the value of equity as of the beginning of year 1? What is the forward P/E multiple (with respect to year 1 earnings) implied by your valuation? What is the trailing P/E multiple (with respect to year 0 earnings) implied by your valuation? (b) What is the growth rate of profit after taxes assumed for year 6 and beyond? State the assumptions needed in order to answer this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts