Question: PROBLEM 4-1 Parent Company Entries. Three Methods LO 2 On January 1, 2016, Perelli Company purchased 90,000 of the 100,000 outstanding shares of common stock

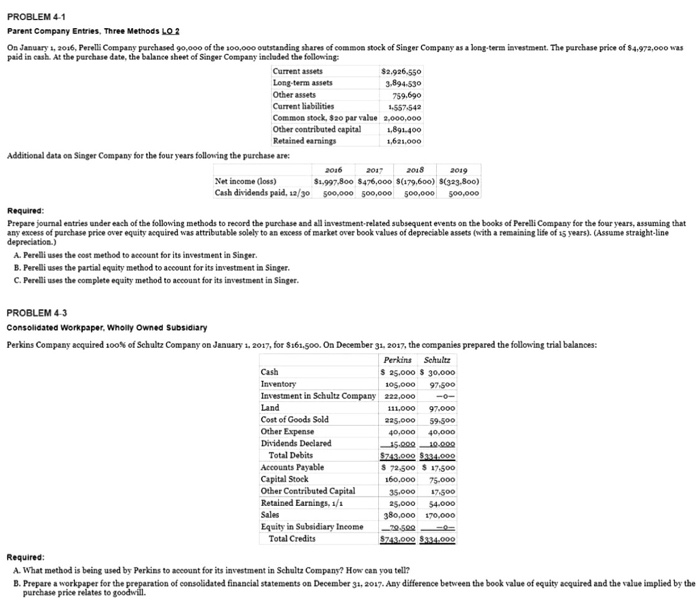

PROBLEM 4-1 Parent Company Entries. Three Methods LO 2 On January 1, 2016, Perelli Company purchased 90,000 of the 100,000 outstanding shares of common stock of Singer Company as a long-term investment. The purchase price of $4,972,000 was paid in cash. At the purchase date, the balance sheet of Singer Company included the following: Current assets $2.926.550 Long-term assets 3.894.530 Other assets 759,690 Current liabilities 1.557 542 Common stock, Sao par value 2,000,000 Other contributed capital 1,891.400 Retained earnings 1,621,000 Additional data on Singer Company for the four years following the purchase are 2016 2017 2018 2019 Net income (loss) $1.997,800 $476,000 $(179,600) $(323.800) Cash dividends paid, 12/30 500,000 500,000 500,000 500,000 Required: Prepare journal entries under each of the following methods to record the purchase and all investment-related subsequent events on the books of Perelli Company for the four years, assuming that any excess of purchase price over equity acquired was attributable solely to an excess of market over book values of depreciable assets (with a remaining life of 25 years). Assume straight-line depreciation.) A. Perelli uses the cost method to account for its investment in Singer. B. Perelli uses the partial equity method to account for its investment in Singer. C. Perelli uses the complete equity method to account for its investment in Singer. PROBLEM 4-3 Consolidated Workpaper Wholly owned Subsidiary Perkins Company acquired 100% of Schultz Company on January 1, 2017, for $161.500. On December 31, 2017, the companies prepared the following trial balances: Perkins Schultz Cash $ 25,000 $ 30.000 Inventory 105,000 97.500 Investment in Schultz Company 222,000 Land 111,000 97.000 Cost of Goods Sold 225.000 59.500 Other Expense 40,000 40,000 Dividends Declared 15.00 10.000 Total Debits $743,000 $334.000 Accounts Payable $ 72,500 $ 17.500 Capital Stock 160.000 75.000 Other Contributed Capital 35,000 17.500 Retained Earnings, 1/1 25,000 54.000 Sales 380,000 170,000 Equity in Subsidiary Income - 70.500 Total Credits 5743.000 $834.000 Required: A. What method is being used by Perkins to account for its investment in Schultz Company? How can you tell? B. Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2017. Any difference between the book value of equity acquired and the value implied by the purchase price relates to goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts