Question: Problem 4-13 Present Value with Different Discount Rates (LG4) Compute the present value of $1,450 paid in three years using the following discount rates: 6

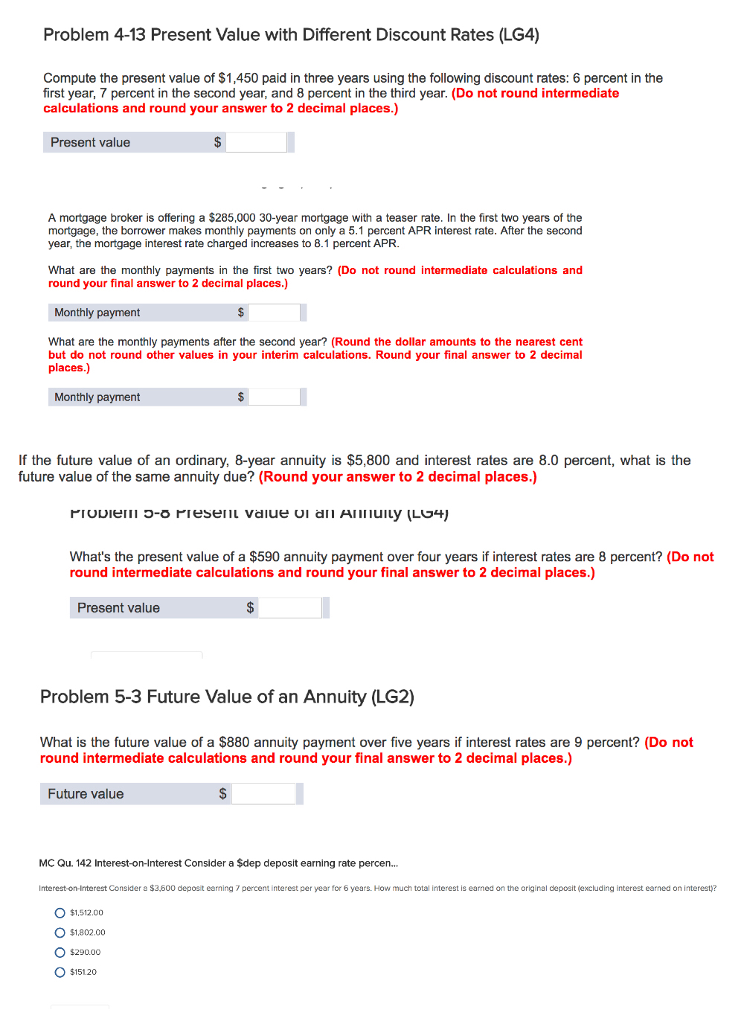

Problem 4-13 Present Value with Different Discount Rates (LG4) Compute the present value of $1,450 paid in three years using the following discount rates: 6 percent in the first year, 7 percent in the second year, and 8 percent in the third year. (Do not round intermediate calculations and round your answer to 2 decimal places.) Present value A mortgage broker is offering a $285,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 5.1 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 8.1 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Round the dollar amounts to the nearest cent but do not round other values in your interim calculations. Round your final answer to 2 decimal places.) If the future value of an ordinary, 8-year annuity is $5,800 and interest rates are 8.0 percent, what is the future value of the same annuity due? (Round your answer to 2 decimal places.) What's the present value of a $590 annuity payment over four years if interest rates are 8 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Problem 5-3 Future Value of an Annuity (LG2) What is the future value of a $880 annuity payment over five years if interest rates are 9 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value MC Qu. 142 Interest-on-Interest Consider a ?dep deposit earning rate percen... Interest-on-Interest Consider a s3,600 deposit earning 7 percent interest per year for 6 years. How much total interest is earned on the original deposit (excluding interest earned on interesty? $1,512.00 O $1802.00 $29000 O $15120 Problem 4-13 Present Value with Different Discount Rates (LG4) Compute the present value of $1,450 paid in three years using the following discount rates: 6 percent in the first year, 7 percent in the second year, and 8 percent in the third year. (Do not round intermediate calculations and round your answer to 2 decimal places.) Present value A mortgage broker is offering a $285,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 5.1 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 8.1 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Round the dollar amounts to the nearest cent but do not round other values in your interim calculations. Round your final answer to 2 decimal places.) If the future value of an ordinary, 8-year annuity is $5,800 and interest rates are 8.0 percent, what is the future value of the same annuity due? (Round your answer to 2 decimal places.) What's the present value of a $590 annuity payment over four years if interest rates are 8 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Problem 5-3 Future Value of an Annuity (LG2) What is the future value of a $880 annuity payment over five years if interest rates are 9 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value MC Qu. 142 Interest-on-Interest Consider a ?dep deposit earning rate percen... Interest-on-Interest Consider a s3,600 deposit earning 7 percent interest per year for 6 years. How much total interest is earned on the original deposit (excluding interest earned on interesty? $1,512.00 O $1802.00 $29000 O $15120

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts