Question: Problem 4-14 (Algorithmic) Passive Loss Umitations (LO 4.8) Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1995 . He

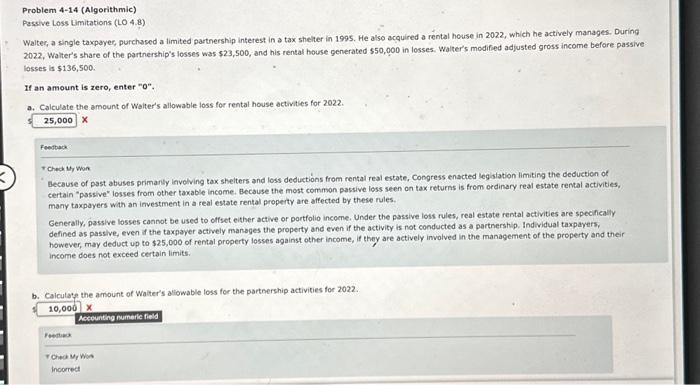

Problem 4-14 (Algorithmic) Passive Loss Umitations (LO 4.8) Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1995 . He also acquired a rental house in 2022 , which he actively manages. During 2022, Walter's share of the parthership's losses was $23,500, and his rental house generated $50,000 in losses. Walter's modifed adjusted gross income before passive losses is $136,500. If an amount is zero, enter " 0 ". a. Calculate the amount of Waiter's allowable loss for rental house activities for 2022. X r chect vy won Because of past abuses primarily levolving tax shelters and loss deductions from rental real estate, Congress enacted legistation limiting the deduction of certain "psssive" losses from other taxable income. Because the most common passive loss seen on tax returns is from ordinary real estate rental activities, many taxpayers with an investment in a real estate rental property are affected by these rules. Generally, passive losses cannot be used to offset either active or portfolio incoene. Under the passive loss rules, real estate rental activities are specincaliy defined as passive, even if the taxpayer actively manages the property and even if the activity is not conducted as a partnership. Individual taxpayers, however, may deduct up to $25,000 of rental property losses against other income, if they are actively involved in the management of the property and their income does not exceed certain limits. b. Calculate the amount of Waiter's aliowable loss for the partnership activities for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts