Question: Problem 4-18 Calculating Future Values [LO 1] You have just made your first $4,000 contribution to your individual retirement account. Assume you eam a 11.20

![Problem 4-18 Calculating Future Values [LO 1] You have just made](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd1b37a33d7_60766fd1b37458b4.jpg)

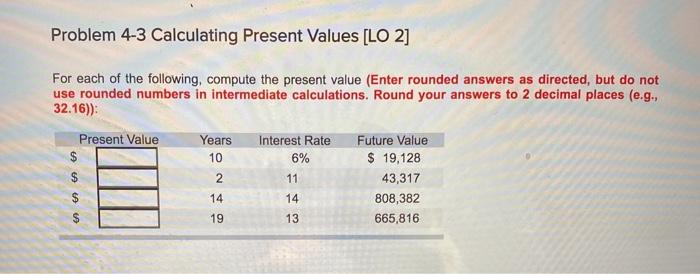

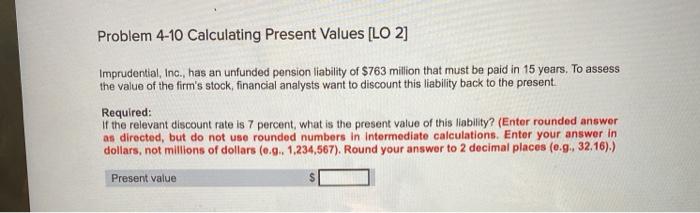

Problem 4-18 Calculating Future Values [LO 1] You have just made your first $4,000 contribution to your individual retirement account. Assume you eam a 11.20 percent rate of return and make no additional contributions. Requirement 1: What will your account be worth when you retire in 41 years? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Amount Requirement 2: What if you wait 10 years before contributing? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Amount Problem 4-3 Calculating Present Values [LO 2] For each of the following, compute the present value (Enter rounded answers as directed, but do not use rounded numbers in intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16)): Present Value Years 10 Interest Rate 6% 2 11 A A A Future Value $ 19,128 43,317 808,382 665,816 14 14 19 13 Problem 4-10 Calculating Present Values [LO 2] Imprudential, Inc., has an unfunded pension liability of $763 million that must be paid in 15 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present Required: If the relevant discount rate is 7 percent, what is the present value of this liability? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Enter your answer in dollars, not millions of dollars (0.9. 1.234,567). Round your answer to 2 decimal places (0.g. 32.16).) Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts